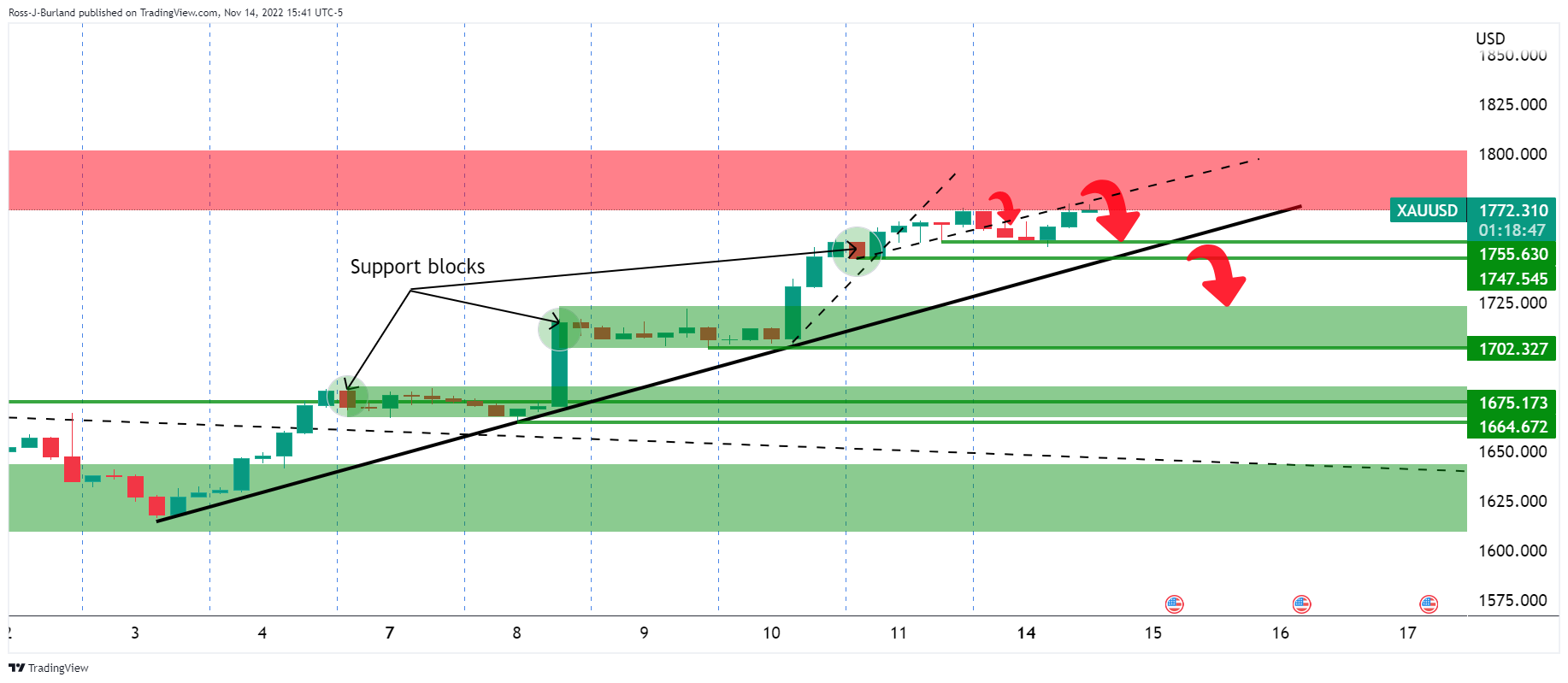

- Gold could be about to enter the recent long built on the November rally.

- Bears are on the lookout for critical resistance as it sets a new corrective high on Monday.

Despite the strength of the dollar, the price of gold rose on Monday to a new three-month high, even as US yields rose after the US Consumer Price Index on Friday disappointed expectations. The yellow metal remains in demand as traders bet the Federal Reserve will ease interest rate hikes following Friday’s inflation data.

Despite the Federal Reserve meeting, in which Fed Chairman Jerome Powell objected to market reaction to a dovish statement, arguing that the final rate could be higher than anticipated, prices for commodities have recovered from year-to-date lows. The change in sentiment has several components, including speculation that China will ease its restrictive zero-covid policies. Due to a series of less inflationary results in the US data, there has been speculation about the possibility of a Fed pivot.

On Friday, US consumer prices rose 0.4% for the month of October and 7.7% for the year. This figure was down from September’s 8.2% yoy and 0.2% below consensus, as was the reading excluding food and energy of 6.3%. The report was well received and market reaction included a 5.5% rise in the S&P 500 and a 26 basis point drop in the 2-year Treasury yield, sending gold soaring and the dollar tumbling. Gold traders have already focused on increasing shorts by money managers in recent months, which has led to significant short covering beyond the $1,720 resistance.

Fed spokesmen in the spotlight

Meanwhile, event risk for the coming week will be Fed speakers, US Retail Sales, Chinese activity data and updates regarding COVID noise in Chinese markets. As for the Fed speakers, the US dollar received a lifeline from the Fed’s Christopher Waller, who gave remarks before the opening and said that Friday’s inflation report was “just a piece of data” and that markets are “way ahead”.

- It will take a run of CPI reports to take our foot off the brake.

- It is positive that the prices of goods have fallen somewhat moderately in services, but this needs to continue.

- The US policy rate is “not that high” given the level of inflation.

- The rate hikes so far have not “broken anything.”

- The US housing market should slow down.

- The signal was to pay attention to the end point, not the pace of rate hikes, and until inflation slows the end point is “a long way off.”

Consequently, the US dollar has been the subject of offers at the beginning of the week: the bullish of the dollar could begin to emerge in the first sessions:

On the other end of the spectrum, Fed Vice Chair Lael Brainard said Monday that it will soon be appropriate for the Fed to slow its rate hikes.

Analysts at TD Valores Bursátiles noted that “Fed speakers are likely to take issue with the overly dovish market reaction to the October CPI report.” Officials will make it clear that following the positive news on the inflation front, there should be further evidence of sustained monthly core inflation that is more in line with their 2% target. And given the continuing strength of the labor market, this may take a while.”

Regarding US Retail Sales, TDS analysts said that “we expect retail sales to accelerate in October, after a broad sideways move in September.” Spending was likely buoyed by a significant increase in car sales and the first gain in gas station sales in four months. Importantly, the control group’s sales likely rose steadily, while those of bars and restaurants likely fell back after two months of expansion.”

Gold Technical Analysis

According to the beginning of the analysis prior to the opening of the week, Gold Chart of the Week: XAUUSD Bears Smacking Their Smack, Watch Lower Time Frame Distributionthe bears of the yellow metals are lurking with the price behind the now broken trend lines (counter trend lines):

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.