- The price of gold continues to rise despite the Bank of Japan surprisingly easing its 10-year bond (JGB) yield.

- The US dollar plunges while the yen soars.

- US Treasury yields and a hawkish Federal Reserve could be the last straw for gold price bulls.

The price of Gold rose on Tuesday as volatility in the market has pushed the US dollar lower due to the rise in the Japanese yen following the Bank of Japan’s (BoJ) surprise move in Asian markets.

Gold price recovery after Bank of Japan surprise decision

The Central Bank of Japan’s decision to increase the yield limit on Japanese ten-year government bonds has shocked markets and turned investors away from US debt. The BoJ will allow 10-year bonds to trade at interest rates of up to 0.5%, up from 0.25% previously, and this cap hike encourages domestic buying of its bonds. However, the price of gold has rallied despite the resulting lower global borrowing costs and the global bond sell-off, probably as a direct effect of the lower US dollar.

The dollar sinks while the yen soars

However, the dollar has tanked according to the DXY index, as the Bank of Japan has shifted gears, sending the yen up around 5% against the dollar. The USD/JPY pair fell from a pre-BoJ high of 137.40 to a low of 130.56. As a result, the US dollar, measured against a basket of currencies including the yen, which accounts for 13.6% of the basket, fell to as low as 103.77. The DXY had reached a high of 104.90 before the Bank of Japan announcement.

US Treasury yields and yield curve ahead

However, rising yields globally could limit the recovery in the price of gold, as gold offers no interest. Yields on 10-year Treasuries rose to 3.710% and two-year yields to 4.312%, though they have started to pull away from their highs and the price of gold is finding demand in late North American trade. However, the US Treasury yield curve between the 2-year and 10-year Treasury notes remains at deep negative levels, signaling concerns about an impending recession, which is generally positive for the dollar.

Federal Reserve sentiment remains key

Going forward, what is going to be critical for the price of gold is the sentiment surrounding the Federal Reserve (Fed). After rising as high as 5.5% after last week’s FOMC meeting, the terminal rate as seen by the swap market returned to just below 5.0% despite the rise in interest rates.

”We cannot understand why the markets continue to fight the Fed,” analysts at Brown Brothers Harriman said. ”With the exception of a few communication missteps here and there, Fed Chairman Jerome Powell and company have been adamant about the need to keep rates higher for longer. Although the media embargo has been lifted, there are no Fed speakers scheduled this week.”

Gold Price Technical Analysis

Previous analysis of the price of Gold:

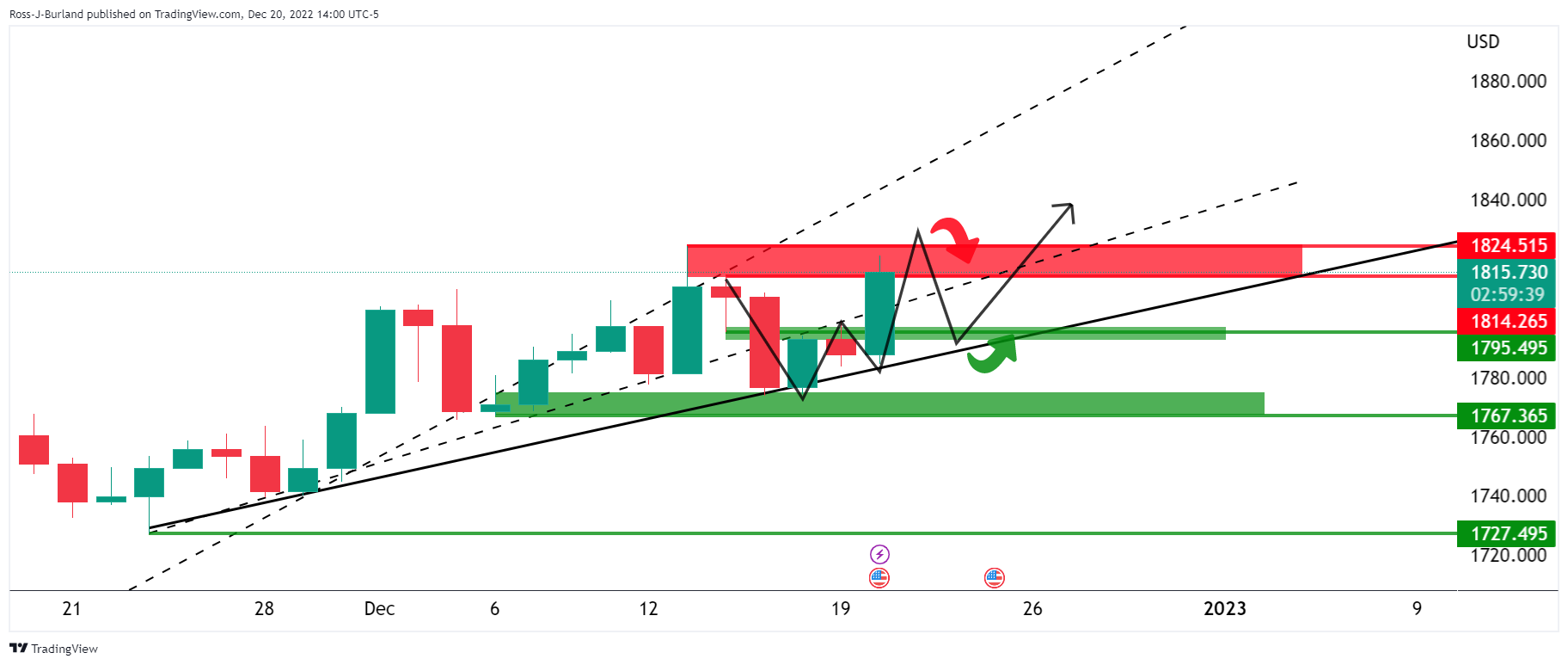

Downside bias in the gold price was claimed to be in play as long as bulls held off below the countertrend lines and $1,800. Instead, the price rose on Tuesday and the winds could be changing. However, the holiday mode markets are already settling in and it is rare for the expected momentum trade setups to play out in what are generally choppy conditions for the gold price.

Gold Price Update

Gold price has turned bullish due to the move towards $1,800 and the bulls are now facing a resistance area.

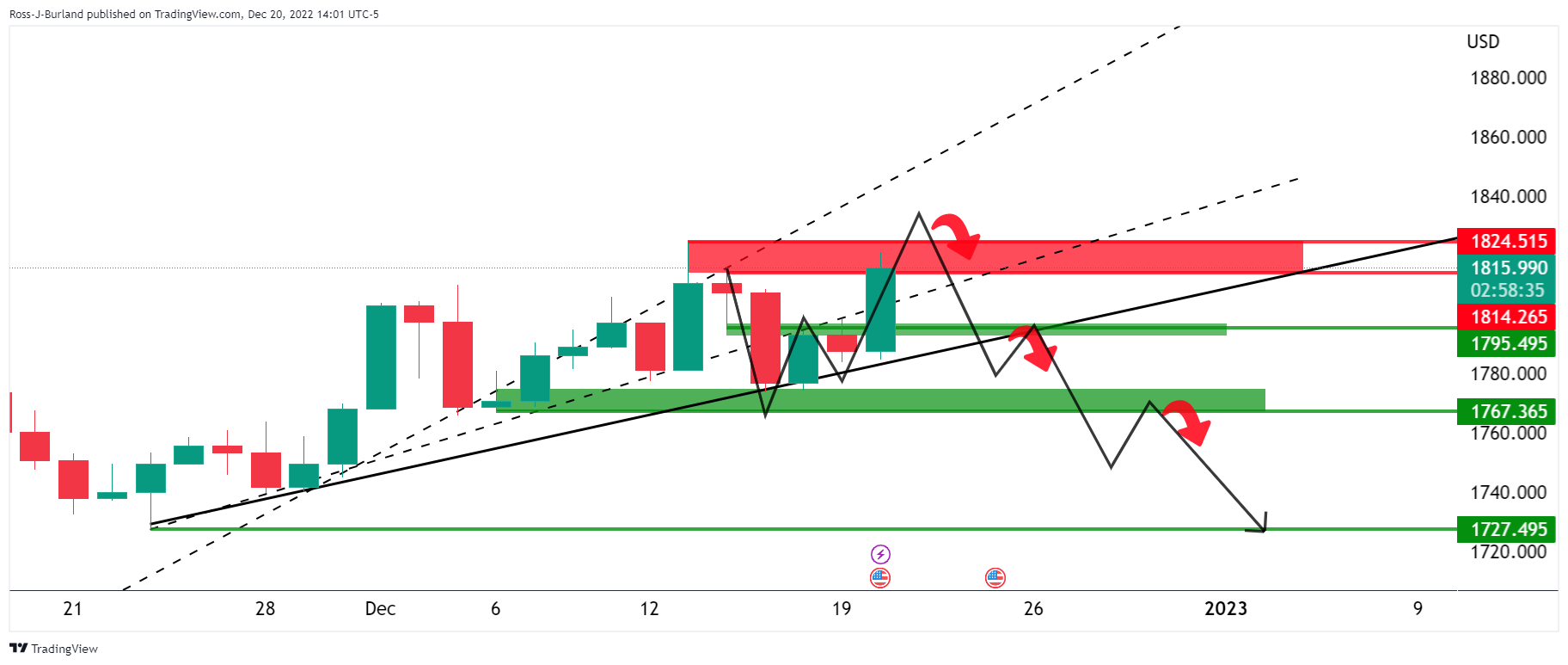

However, gold price markets do one of three things: 1) break, pull back, and continue 2) break, pull back, and reverse, or 3) break, pull back, and enter a trading range.

Gold Price Scenario 1:

Gold Price Scenario 2:

Gold Price Scenario 3:

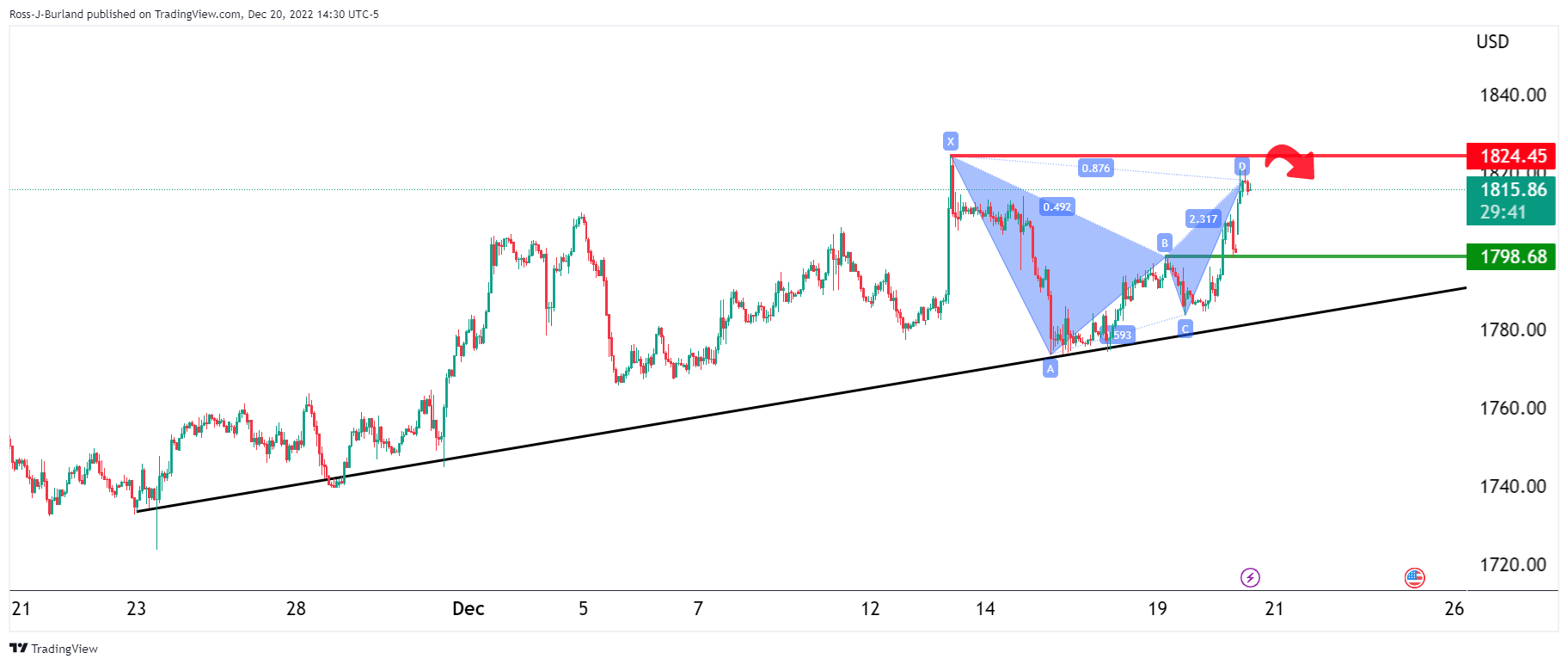

Gold Price Lower Time Frames

Gold price on the 1 hour chart is bearish as long as it is below resistance near $1,825 but not until Gold price moves to the back of the micro trend line:

On the 15 minute chart for the price of Gold, we can draw the extensions to the downside based on the presumed box of sideways consolidation that could form in the next sessions/days due to the pull of the harmonic bearish pattern on the daily chart of Gold. gold price.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.