- Initially, the price of gold was reluctant to go lower due to the big surprise in US retail sales.

- Gold price bears are slowly reappearing as the dust settles.

US Retail Sales rose 3% in January, shattering expectations despite a rise in inflation that might otherwise have kept consumers with their hands in their pockets. So far, the price of gold has remained in the ranges known before the data, around $1,835.

The Dollar Index strengthened to almost 104 on Wednesday, the highest level in almost five weeks, after a stronger-than-expected US CPI report reinforced expectations that the Federal Reserve will have to keep raising interest rates. to reduce inflation. In the New York session it was below 104 as traders prepared for the Retail Sales data, which kept Gold bulls in the game ahead of the data.

On Tuesday, the US annual inflation rate slowed slightly to 6.4% in January from 6.5% in December, the lowest since October 2021, but above market expectations of 6.2%. The latest Fed comment also showed policymakers were largely backing more rate hikes, fueling a bid in the dollar after what was an indecisive show from markets around inflation data initially.

With the latest data showing that retail sales rebounded more than expected in January, and rose to the most since March 2021, highlighting the strength of the economy, the US dollar has not yet been able to get off the ground, what is giving gold bulls a lifeline today:

Gold technical analysis.

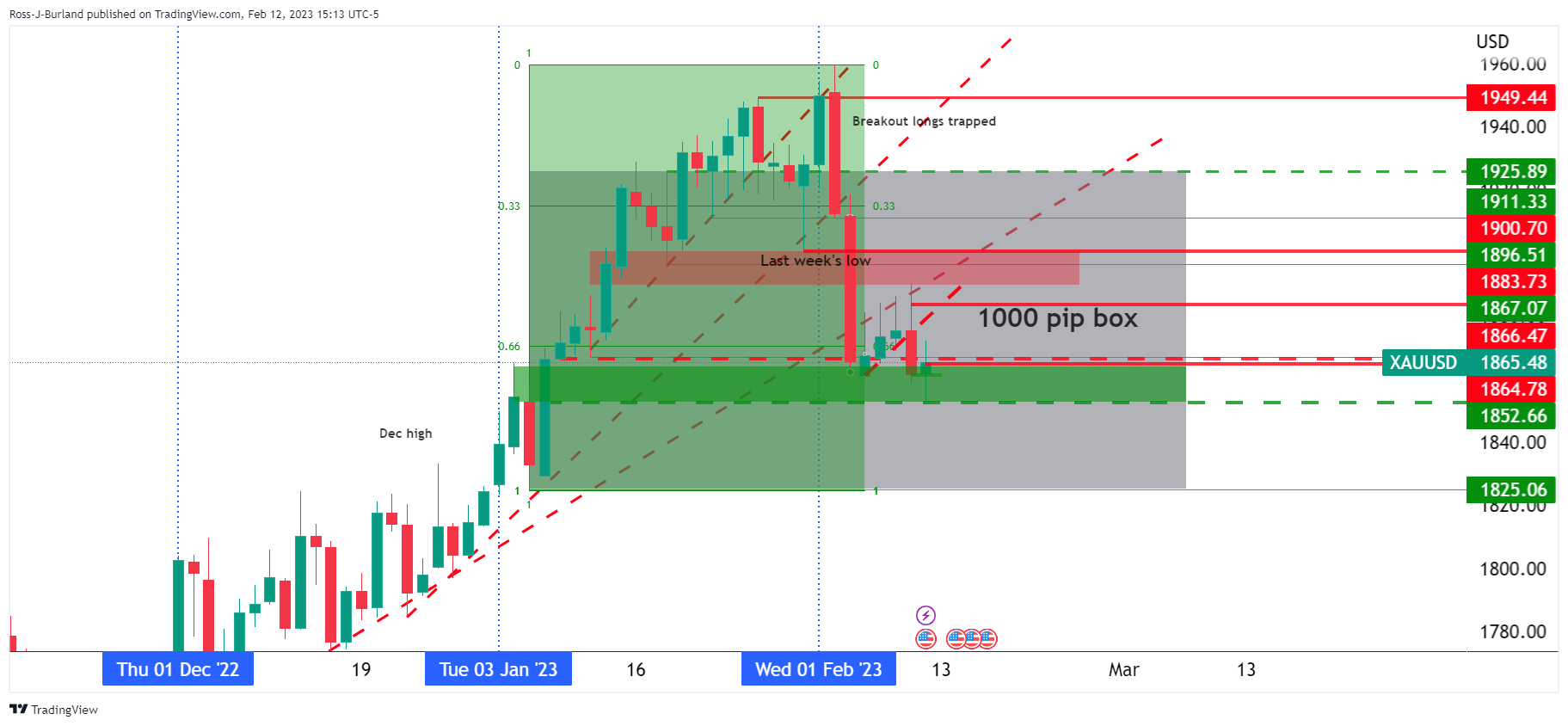

From a daily perspective, the price would be expected to make a 1000 point move to $1,825 for which traders were trapped long earlier in the month. In previous analyses, it was stated that we were in the upper third of the 2023 range and after the first trend line which is broken and acting as a counter-trend line. A break of $1,925 was expected to open up the risk of a move to test $1,896 and then $1,867 as the top of the lower third of the range that held a 1,000-point cash low at $1,825:

The chart above is an analysis done at the end of January and below is the current situation prior to the week beginning February 12:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.