- Factory-gate inflation in the United States continued its downward trend, except for core inflation.

- The requests for unemployment benefits in the last week increased for the second week in a row.

- Gold Price Analysis: Ready to test ATH around $2,075; otherwise, it could fall below $2,000.

Gold price is advancing but staying away from year highs, previously hit around $2,048.79, after US data continued to show the economy slowing. Therefore, the US dollar (USD) weakened as US Treasury yields continued their downward trajectory while Gold rallied on safe-haven flows. He XAU/USD It is trading at $2,039.10, after hitting a low of $2,013.90.

Prices down in the US due to the cooling of inflation

The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index (PPI) for March fell 0.5% MoM, below estimates of 0%. The so-called core PPI, which excludes volatile items, fell 0.1% m/m, below the 0.3% consensus forecast. Compared year-on-year, the PPI stood at 2.7%, below the 3% market forecast, while the core PPI held at 3.4%. This weighed on the US dollar (USD), which lost 0.61%, according to the Dollar Index, which stood at 101.913.

Initial claims for US jobless benefits rose for the second week in a row

At the same time, initial claims for jobless benefits for the week ending April 8, reported by the Bureau, beat expectations, coming in at 239,000, versus an estimated 232,000. These data, along with the steady slowdown in inflation in the United States, weighed on the dollar and strengthened the price of gold, which is hovering around $2,040.

Will the latest US data trigger a Fed pivot?

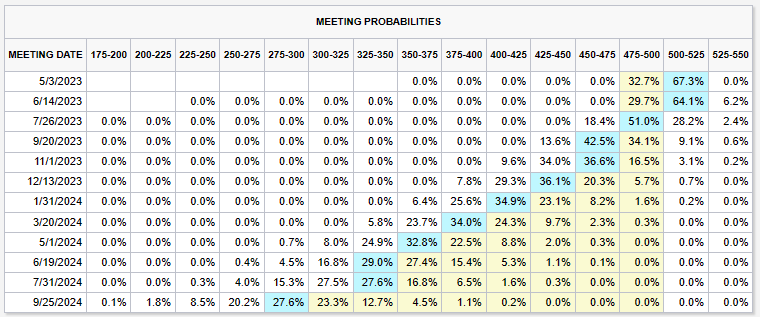

Against this background, the dollar remained in supply in the foreign exchange market and against dollar-denominated commodities. Expectations that the US Federal Reserve (Fed) is about to end its tightening cycle flooded financial markets, with the Federal Funds Rate (FFR) expected to hit a high of 5.00% – 5.25 %. According to the CME Fed WatchTool, the odds of a 25 basis point hike in May stand at 67.3%, but market participants have begun to price in rate cuts. Investors estimate that the FFR will end 2023 in the 4.25% – 4.50% range. This means that, after the rise in May, 75 basis points of rate cuts are expected.

The Federal Reserve remains committed to controlling inflation.

Meanwhile, Federal Reserve policymakers, led by the San Francisco Fed’s Mary Daly, said “policy may need to tighten further to reduce inflation,” though they acknowledged there are good reasons. for the economy to “continue to slow, even without further monetary policy tightening” Earlier, Richmond Fed President Thomas Barkin said inflation had peaked but warned there was still some way to go.

XAU/USD Technical Analysis

After breaching the previous all-time high of $2,032.13, the XAU/USD pair fell before posting another challenge to reach a new all-time high. That happened six days later, with the price of gold reaching a new year high, far from the psychological level of $2,050. For a bullish resumption, XAU/USD needs to break above $2,050 so that it can challenge the ATH at $2,075.14 before targeting $2,100. On the other hand, if XAU/USD returns below $2,000, this would pave the way for a break below $2,000. Once this occurs, the next support for XAU/USD would be the April 10 low at $1,981.78, followed by the 20-day EMA at $1,981.25.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.