- The price of gold rebounds after the publication of non-farm payrolls.

- The bulls are looking for a break of $1,850 to regain control.

the price of gold It rose for the third day in a row on Friday, but is heading for a weekly drop as prospects for further interest rate hikes dampened the precious metal’s appeal, while traders awaited the US Non-Farm Payrolls report. ..

Gold has rallied to a new corrective high near $1,845 as markets are pricing in the odds of a 50 basis point rate hike from the Federal Reserve this month. The main disappointments came in the Unemployment Rate, which was expected to remain unchanged at a record low 3.4%, while average hourly earnings were also a major disappointment.

However, when combined with yesterday’s JOLTS, in which the Federal Reserve’s favorite measure of the strength of labor demand, the vacancy-to-unemployment ratio (“V/U ratio”), these The reports do not bode well for a Fed expecting a significant slowdown in the labor market.

Analysts from TD Securities explained that yesterday, ”the V/E ratio remained at an all-time high of 1.9 vacancies per jobless person. In terms of layoffs, the layoff rate went down to 2.5%, the lowest level in two years, but the layoff rate remained quite low at 1.1% and in line with what we’ve seen in 2022.” Overall, a strong report in line with continued strength in the labor market,” the analysts argued.

However, non-farm payrolls have not signaled in some key areas, although this could be seen as a mean reversal in February, following the success of the report, which saw job creation soar to an unexpected 517,000 jobs. in january.

In the previous session, jobless claims surprised to the upside during the first week of March, breaking above the 200,000 level for the first time in 8 weeks. The series stood at 211,000, up from 190,000 previously. These data discouraged the president of the Federal Reserve, Jerome Powell, who in his appearance before Congress warned that a rise of 50 basis points was not ruled out. However, it is worth noting that the average claims in 2018-19 was 220,000, so the series is still somewhat below the pre-Covid trend.

Fed fund futures had already been showing that investors had lowered the probability of a 50 basis point hike by the Fed in March to 56%, after having been as high as 75% following the speech. from Powell this week.

Gold Technical Analysis

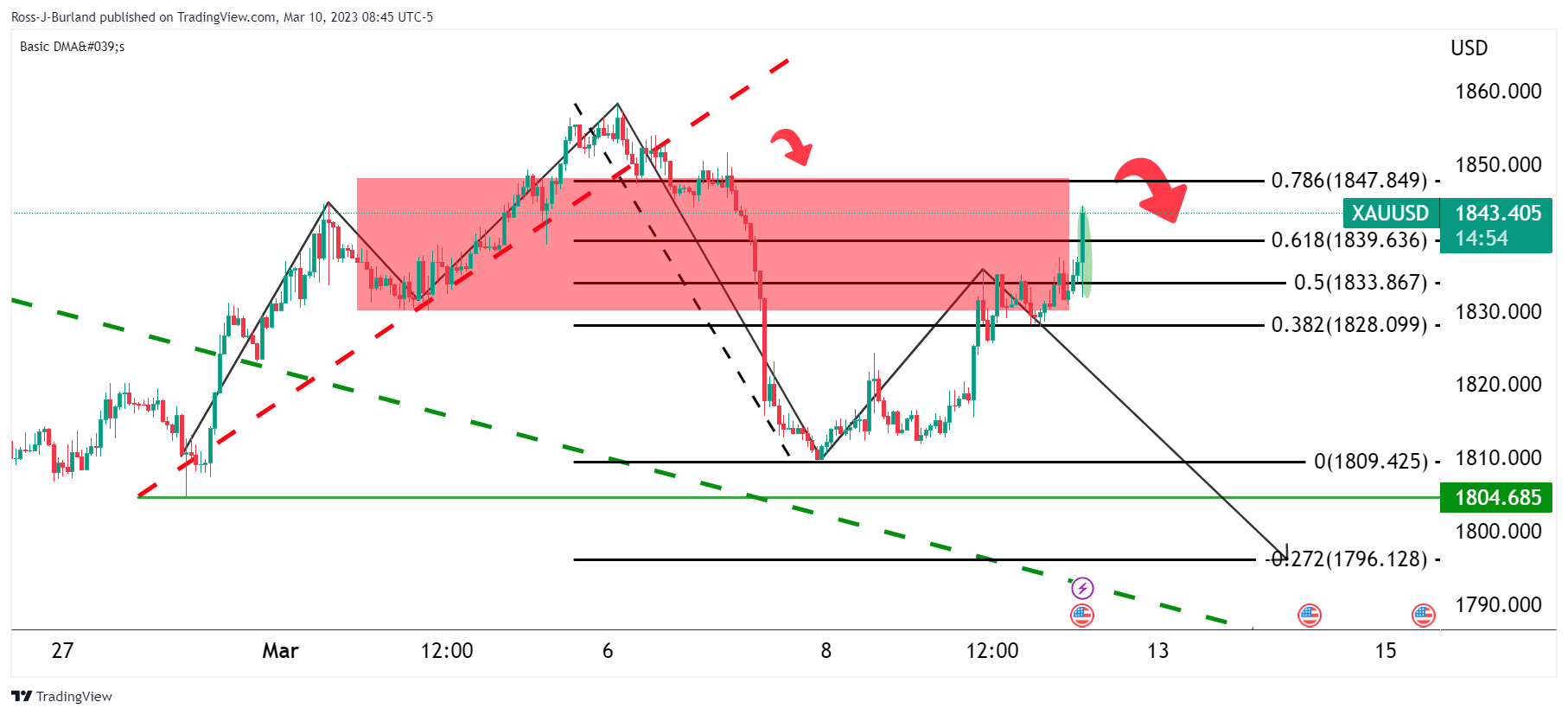

Heading into the event, gold price crossed back above $1,825 looking for the neckline of the M formation around the 50% reversal mark:

Gold Price Update

As illustrated, the price of Gold has rallied. There is support to the downside at $1,804 with resistance above $1,850. If the bears move again, then there will be prospects for a move to test the 200 DMA in the coming days with $1.17704 in the offing along those lines. If $1,850 gives way to bulls, then there will be prospects for a move above the double top of the M formation with $1,900 exposed:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.