- Gold remains firm around $1,835, awaiting the Fed Minutes.

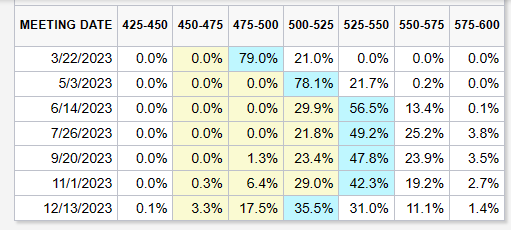

- Money Market Futures began quoting US interest rates at 5.25%-5.50%.

- Gold Price Analysis: Range Boundary, trapped within the 50 and 100 DMA.

The price of gold It is picking up some ground, although it remains almost flat compared to its opening price. However, it is holding on to minimal gains ahead of the release of the minutes of the latest US Federal Reserve (Fed) policy meeting. At the time of writing, XAU/USD is trading at $1,835.10 per troy ounce.

Financial markets awaiting the Minutes of the last FOMC meeting

US stocks rebounded at the open on Wall Street, but traders remained cautious amid growing speculation that the Fed would turn more hawkish than expected. Money market futures see an additional 75 basis points of tightening, according to the CME’s Fed Watch tool. However, dollar bulls are taking a breather, with the US Dollar Index (DXY) down 0.07% to 104.088, weighed down by US bond yields, mainly the 10-year yield, which fell five basis points (bp), up to 3,900%.

Source: CME FedWatch Tool

The strength of the US economy justifies the hawkish rhetoric of Fed officials

Tuesday’s data release, particularly S&P Global PMI for February, showed that business conditions in the United States (US) are improving, with both services and composite PMI beating estimates and expanding territory. The outlier was the Manufacturing index, which improved but remained in the contraction zone.

The US PMI data added to last week’s inflation and justify the need for further rate hikes by the Fed, whose officials, led by the presidents of the Cleveland and St. Louis Feds, Loretta Mester and James Bullard, stated that there was convincing evidence to raise rates 50 basis points at the single meeting in February.

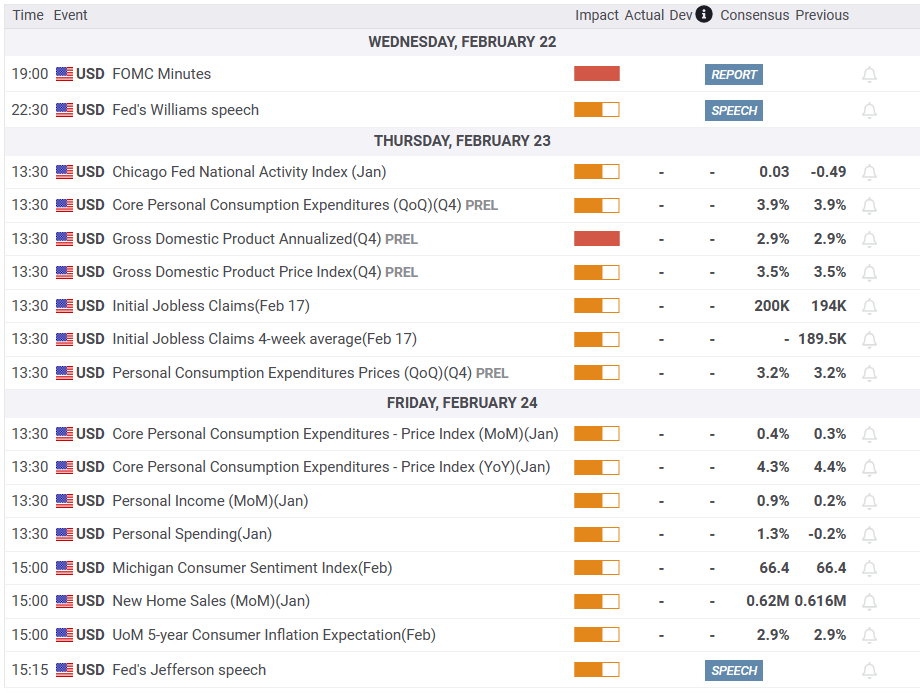

What is there to watch out for?

Gold Technical Analysis

The daily chart for XAU/USD suggests that the yellow metal has consolidated after reaching a daily high of $1,846.09. However, the release of the Fed minutes could cause bullish or bearish movements in the yellow metal. Oscillators point lower, specifically the Relative Strength Index (RSI) and the Rate of Change (RoC).

Therefore, the first support for XAU/USD would be the 100-day EMA at $1,820.59, followed by last week’s low of $1,818.97. A break of the latter would expose the 200 day EMA at $1,803.04.

As an alternate scenario, a break above $1,847.45 and the next target for XAU/USD would be $1,850, immediately followed by the 50 day EMA at $1,852.50 and the $1,852.50 EMA. 20 days at $1,862.52.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.