- The price of gold fell below $1,700, after the report on employment in the United States.

- US non-farm payrolls beat estimates by 263,000, with further Fed hikes looming.

- US Treasury yields rose, holding above 3.80%.

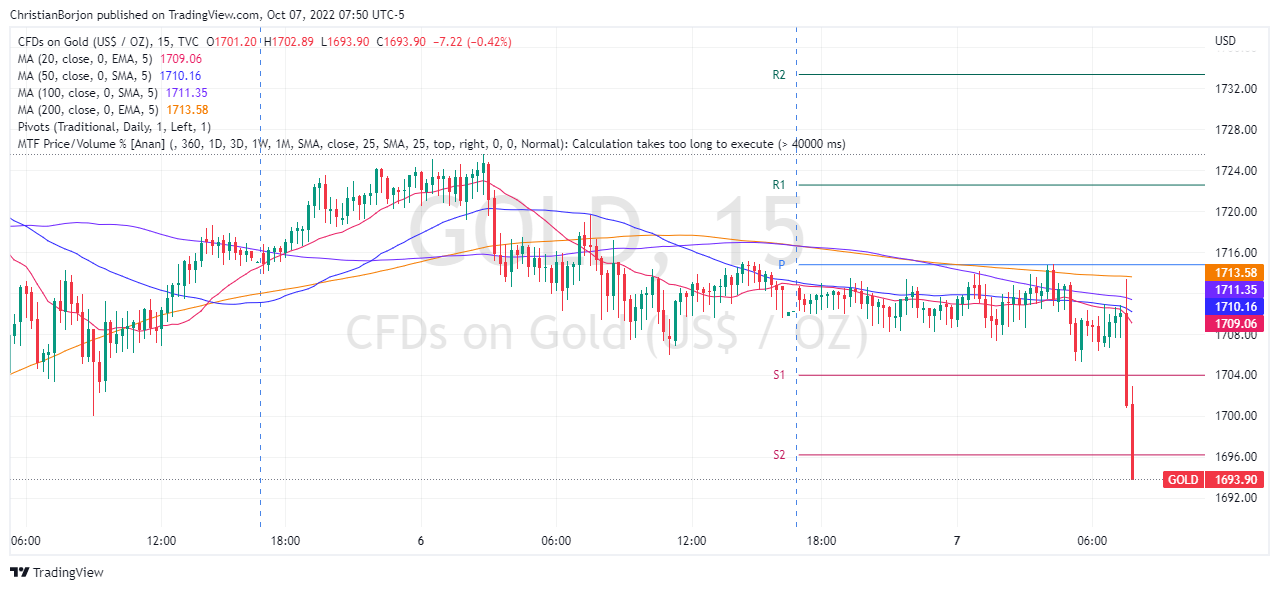

the price of gold fell after the US Department of Labor reported employment figures, which beat estimates, justifying the need for the Fed to continue to tighten monetary policy, which strengthens the dollar. Therefore, XAU/USD is trading around $1,690, below its opening price.

Prior to the release of the US Non-Farm Payrolls report, the yellow metal was hovering around $1,710. However, once the report was released, gold’s initial reaction dipped towards the $1,700 area, but the initial move dissipated. However, at the time of typing, he extended his losses below $1,700 in a reaction to volatility.

US data reported by the Bureau of Labor Statistics (BLS), showed that the US economy added 263,000 new jobs, beating estimates of 250,000, while the Unemployment Rate fell to 3.5%. , from expectations of 3.7%. Despite being lower than August, it beat estimates, which would further strengthen the case for a Federal Reserve rate hike.

Meanwhile, money market futures have priced in a 92% chance that the Fed will raise interest rates by 75 basis points, down from 85.5% prior to the US Non-Farm Payrolls report.

US Treasury yields rose, with the 10-year Treasury yield rising three basis points to 3.865%, while the Dollar Index, a gauge of the dollar’s value against six currencies, rose 0.28% to 112,565.

What must be considered

Now that the US Non-Farm Payrolls report is in the rearview mirror, the next big events on the US calendar would be the September CPI figures and the University of Michigan Consumer Sentiment in the next week.

Gold 5 minute chart

Key Gold Technical Levels

XAU/USD

| Overview | |

|---|---|

| last price today | 1693 |

| Today I change daily | -11.03 |

| Today Daily change % | -0.64 |

| Daily opening today | 1712.44 |

| Trends | |

|---|---|

| daily SMA20 | 1679.92 |

| daily SMA50 | 1723.52 |

| daily SMA100 | 1761.18 |

| daily SMA200 | 1822.73 |

| levels | |

|---|---|

| Previous daily high | 1725.61 |

| Previous Daily Low | 1706.97 |

| Previous Weekly High | 1675.49 |

| Previous Weekly Low | 1614.85 |

| Previous Monthly High | 1735.17 |

| Previous Monthly Low | 1614.85 |

| Daily Fibonacci 38.2% | 1714.09 |

| Daily Fibonacci of 61.8% | 1718.49 |

| Daily Pivot Point S1 | 1704.4 |

| Daily Pivot Point S2 | 1696.37 |

| Daily Pivot Point S3 | 1685.76 |

| Daily Pivot Point R1 | 1723.04 |

| Daily Pivot Point R2 | 1733.65 |

| Daily Pivot Point R3 | 1741.68 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.