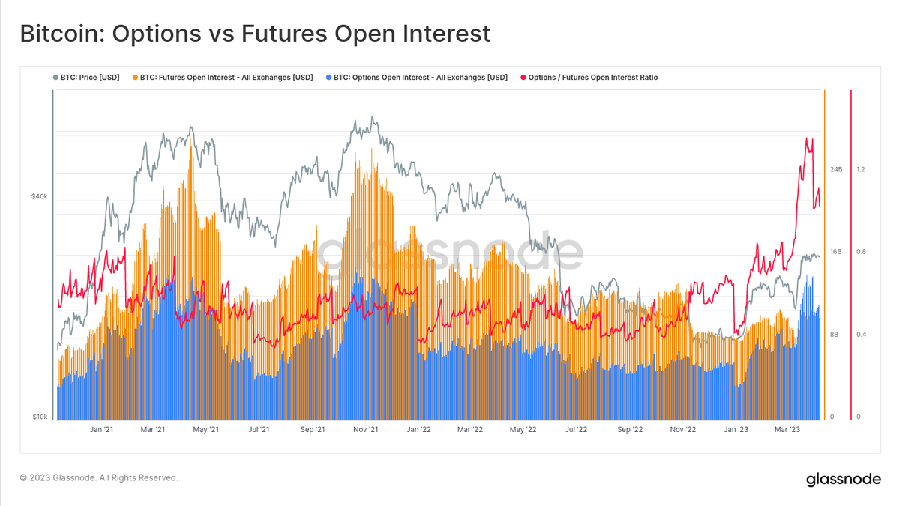

In conclusion, Glassnode experts cite data: the rapid increase in open interest (OI) is due to the fact that crypto traders are buying up a significant number of call options denominated in bitcoins. This gives them the right to buy BTC at a certain value, regardless of the actual spot price level.

According to the Glassnode chart, reflective

the current state of the market, the amount of OI for contracts for bitcoin options reached $10.3 billion. While the volume of OI for futures contracts for the supply of an asset was fixed at $10 billion.

According to Glassnode analysts, the excess of open interest in bitcoin options contracts over the amount concluded in futures contracts illustrates the preparation of crypto traders to speculate on the volatility of the asset in anticipation of a higher BTC value.

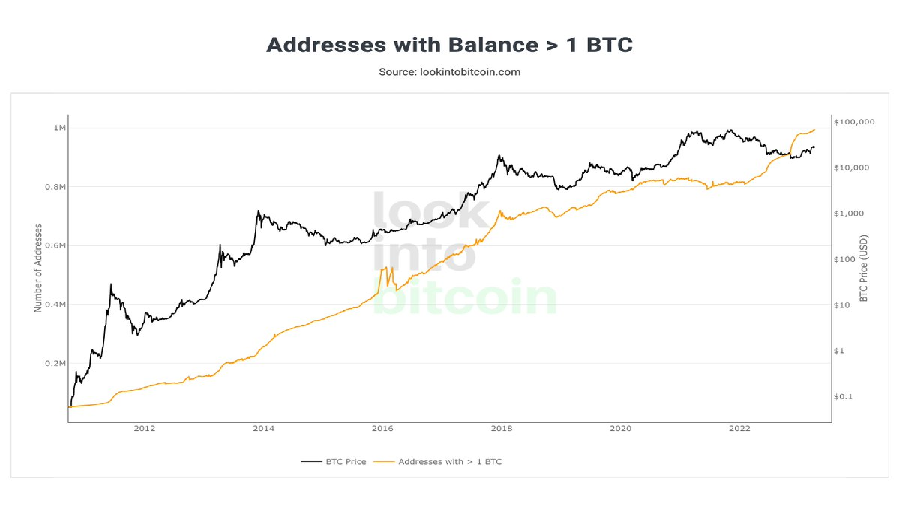

Glassnode notes that an increase in investor interest and an increase in the price of the flagship cryptocurrency have led to the fact that the number of non-zero BTC addresses has sharply increased. increased to 45.5 million, which indicates an increase in the activity of the Bitcoin network as a whole.

Earlier, Glassnode released data showing that almost half of the total volume of bitcoins has been withdrawn from circulation and has not been involved in operations for more than two years. About 9.45 million BTC are held on wallets, which at current prices is almost $270 billion.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.