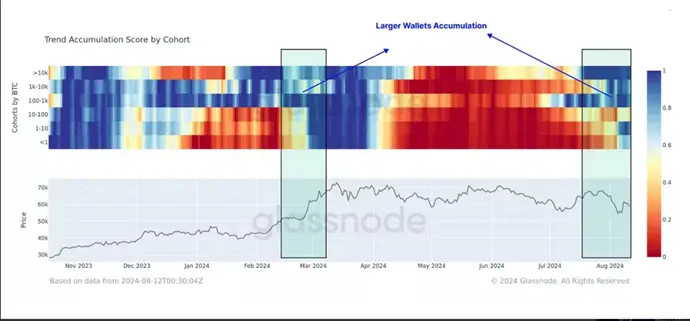

Hodling has increased among owners of large cryptocurrency wallets, according to Glassnode. The behavior is indicated by the Accumulation Trend Score (ATS) metric, which evaluates the change in balance on the market. The indicator recorded the maximum possible value – 1.0.

This indicates a significant accumulation of bitcoins over the past few weeks, analysts said.

“The long-term accumulation of Bitcoin by investors suggests that market participants generally expect positive dynamics in the short and medium term,” the experts explained.

The sideways market movement over the past few months has caused a significant slowdown in the rate of distribution of bitcoins by hodlers, and as a result, the share of the first cryptocurrency owned by this group has started to grow again.

“There is potential for further pressure from long-term investors if the Bitcoin rate rises. HODLers are in no hurry to part with their coins at lower prices,” the analysts explained. Glassnode.

In their opinion, long-term holders are expecting higher prices for the first cryptocurrency before returning to active selling in the market.

Earlier, PitchBook stated that the volume of venture investments in the crypto industry grew by 2.5% in April-June, and for the third quarter in a row, there has been a positive trend in capital raising.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.