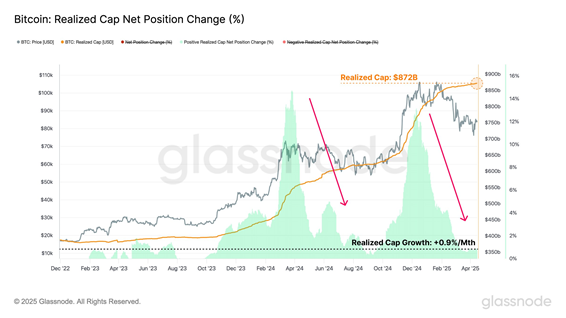

The implemented capitalization of the first cryptocurrency reached a historical maximum of $ 872 billion. However, investors reduces Bitcoin’s appetite.

“This indicates the saturation of the activity of the players and often precedes the consolidation phase, since the market is looking for a new balance, being on the border between bull and bear trends,” Glassnode said.

Now sales pressure are observed from the side of small retail investors, while whales and experienced players continue to accumulate bitcoin in anticipation of the growth of the asset in the long term, experts explained.

In their opinion, the current cryptocurrency price will not lead to an increase in the number of new market participants, and the activity of the asset holders will be at a low level for the next few weeks.

Earlier BitWise analysts They called it The results of the first quarter for bitcoin and the market are pessimistic, but said that in the second quarter, in April – June, the first cryptocurrency could demonstrate a bull trend.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.