- GBP/USD is down 0.42% to trade at 1.2567 as the UK’s S&P Global/CIPS Composite PMI Index falls to 48.6, entering contractionary territory for the first time since January.

- Despite weaker than expected PMIs, the UK central bank is expected to raise rates by 25 basis points.

- US factory orders beat estimates but remained in recessionary territory and could influence Fed officials’ decision at the next meeting.

The British Pound (GBP) erased Monday’s gains against the US dollar (USD) after business activity entered recessionary territory in the UK. This, together with weaker-than-expected global services PMIs, favored safe-haven flows. Hence GBP/USD is trading at 1.2567, down 0.42%, after reaching a daily high of 1.2631.

The British Pound falls on the gloomy data of the British PMI and the slowdown of the world economy

During the European session, the UK’s S&P Global/CIPS Composite PMI Index fell to 48.6 in August from 50.8 in July, its lowest reading since January, dragged down by the decline in the services PMI, which stood at 49.5. , below the threshold of 50 that separates the expansion/contraction territory. Meanwhile, data from China and the Eurozone (EU) highlighted the slowdown in most world economies.

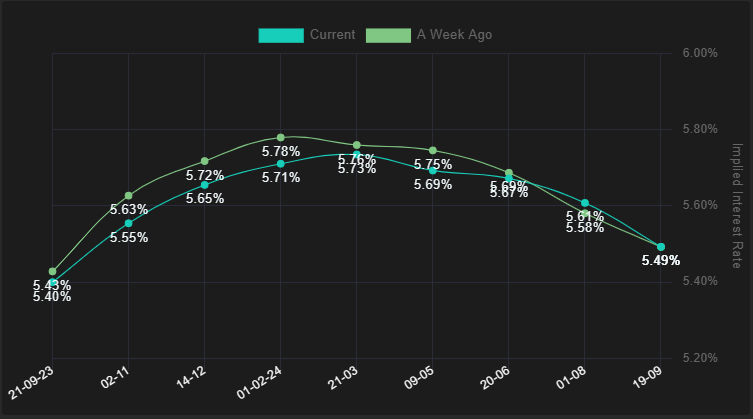

Although the data suggests that economic conditions would not warrant an additional rate hike by the Bank of England (BoE), money market futures expect a 25 basis point rate hike, as interest rate probabilities show. The odds stand at 87% that the BoE will raise the bank rate for the 15th time, since Andrew Bailey and company began their tightening cycle in December 2021. As the image below shows, market participants estimate that the BoE it will go up again in early 2024.

Bank of England: Interest Rate Odds

Source: Financial Source

Across the pond, August factory orders in the United States (US) came in at -2.1%, better than the -2.5% estimate, according to the US Department of Commerce. This data comes after four consecutive months of increases. The impact of the Fed’s 525 basis point tightening continues to chill the US economy. Traders hope the Fed won’t raise rates at the next meeting, but still see a November hike as possible.

Turning to the central bank news, Fed Governor Christopher Waller noted that the Fed has room to decide the next interest rate decision. Later, Cleveland Fed President Loretta Mester said the Fed will not continue to tighten until inflation reaches 2%, nor will it wait until there to lower rates.

US Treasury yields are rising moderately, with the 10-year Treasury yield trading at 4.263%, gaining six basis points and supporting the US Dollar (USD). The US Dollar Index (DXY), which measures the value of the dollar against a basket of currencies, advanced 0.60% to 104,777, the highest level since March 13 of last year.

Release of the US ISM non-manufacturing PMI for August, which will show a slight slowdown from 52.7 to 52.5 points. Similarly, the S&P Global Services PMI is likely to show a comparable trend, with estimates of 51, up from 52.3 in July. If both readings line up with expectations, this could put pressure on the US dollar. These results could reinforce the Federal Reserve’s pause in September and reduce the probability of a further interest rate hike in November.

GBP/USD Technical Levels

GBP/USD

| Overview | |

|---|---|

| Last price today | 1,257 |

| Today Change Daily | -0.0056 |

| today’s daily variation | -0.44 |

| today’s daily opening | 1.2626 |

| Trends | |

|---|---|

| daily SMA20 | 1.2685 |

| daily SMA50 | 1.2775 |

| daily SMA100 | 1.2652 |

| daily SMA200 | 1.2419 |

| levels | |

|---|---|

| previous daily high | 1.2643 |

| previous daily low | 1.2587 |

| Previous Weekly High | 1.2746 |

| previous weekly low | 1.2563 |

| Previous Monthly High | 1.2841 |

| Previous monthly minimum | 1.2548 |

| Fibonacci daily 38.2 | 1.2621 |

| Fibonacci 61.8% daily | 1.2608 |

| Daily Pivot Point S1 | 1.2595 |

| Daily Pivot Point S2 | 1.2563 |

| Daily Pivot Point S3 | 1.2539 |

| Daily Pivot Point R1 | 1,265 |

| Daily Pivot Point R2 | 1.2674 |

| Daily Pivot Point R3 | 1.2706 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.