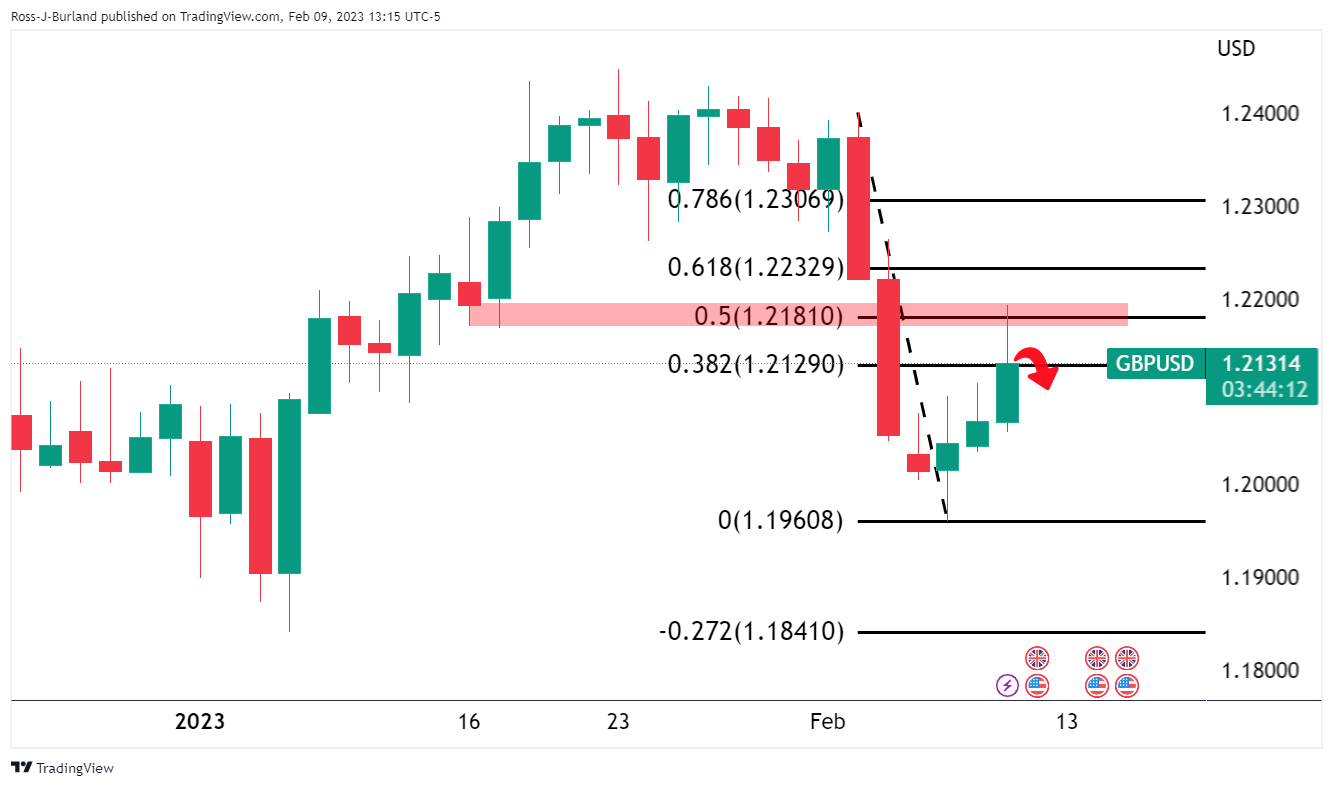

- GBP/USD has sold off since a 50% mean reversal of the previous daily bearish momentum.

- A follow-through to 1.20 is seen, but price is finding some support at this juncture.

- This opens up the risk of a correction before the next move lower.

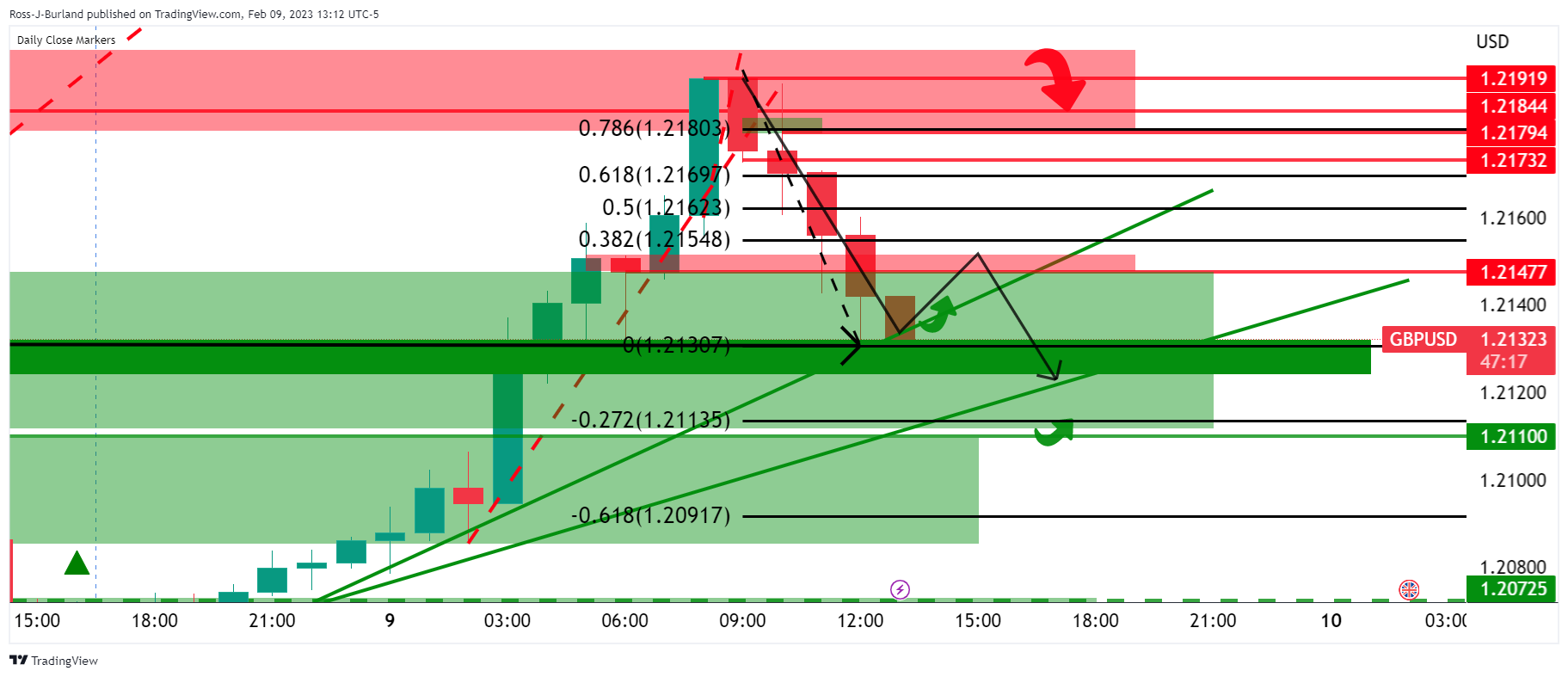

He GBP/USD rallied parabolically on Thursday on the third day of sterling demand. The pair moved from a low of 1.2056 to a high of 1.2194 before pulling back to test the midpoint of the 1.21 zone and recently reaching a sell-off low of 1.2130.

The dollar broke out of the bearish structure late in the London session and extended the move until the open of the American session, before retracing the session. Risk aversion sent the dollar tumbling and the pound off a cliff, as shown below:

DXY H1 Chart

US500 H1 Chart

GBP/USD Technical Analysis

GBP/USD has fallen into the parabolic rally and length that has been building over the course of the week starting on Tuesday. We were three levels up since the opening of the Asian session in a massive pump that has concluded in a spill in the New York session at the opening time of Wall Street, 17:30 GMT and in the London session at 16 :00 GMT. We are seeing follow through to 1.20, but price is finding some support at this juncture:

This opens up the risk of a correction before the next move lower with the 117 pip ATR for the day already made within the 137 pip range so far:

A bullish close on the day will be giving us three bullish closes in a row and leaves the risk of another sell-off on Friday:

Price has already corrected to a 50% mean reversal of the previous daily bearish momentum.

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.