- GBP/USD continues to rise with bulls targeting the 38.2% Fibonacci target around 1.2120.

- In the 15-minute chart, GBP/USD is breaking the structure after recording a higher low in the American session.

- A break of 1.2092 is now what the bulls need to solidify the prospects for higher momentum by the end of the day.

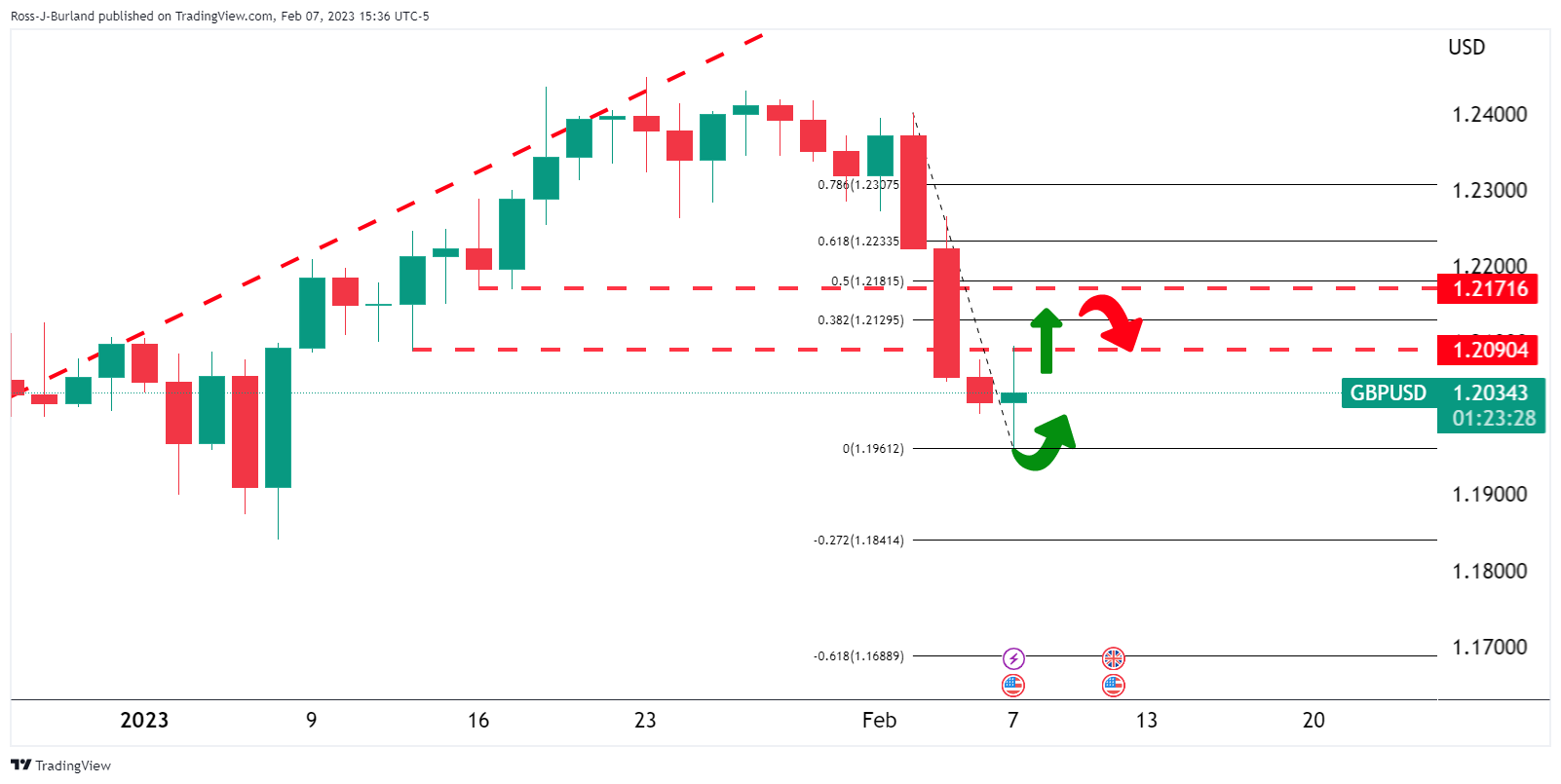

Based on the above analysis, GBP/USD Price Analysis: The bulls will move on the break of the bearish structure of 1.2090, the price rose on a continuation of the bullish correction on the daily bearish momentum as stated in the article. We are now in a bullish reversal of the American session with targets for a second bullish close by midweek as illustrated below.

GBP/USD Previous Analysis

GBP/USD bulls moved in on Tuesday and set the stage for an upward correction of the dip from 1.23 in early February. Illustrated below is the uptrend for Wednesday (today):

The price had rallied from a low of 1.1960 to a high of 1.2095, taking Monday’s high, MH, and breaking structures, BoS, along the way. The price had also moved back from the previous bearish dynamic resistance, (Line of downtrend), which was expected to act as a counter-trend line.

The breakout of those structures left the directional bias in favor of a bullish correction on the daily chart for Wednesday, awaiting a bullish close on Tuesday (yesterday):

Extended…

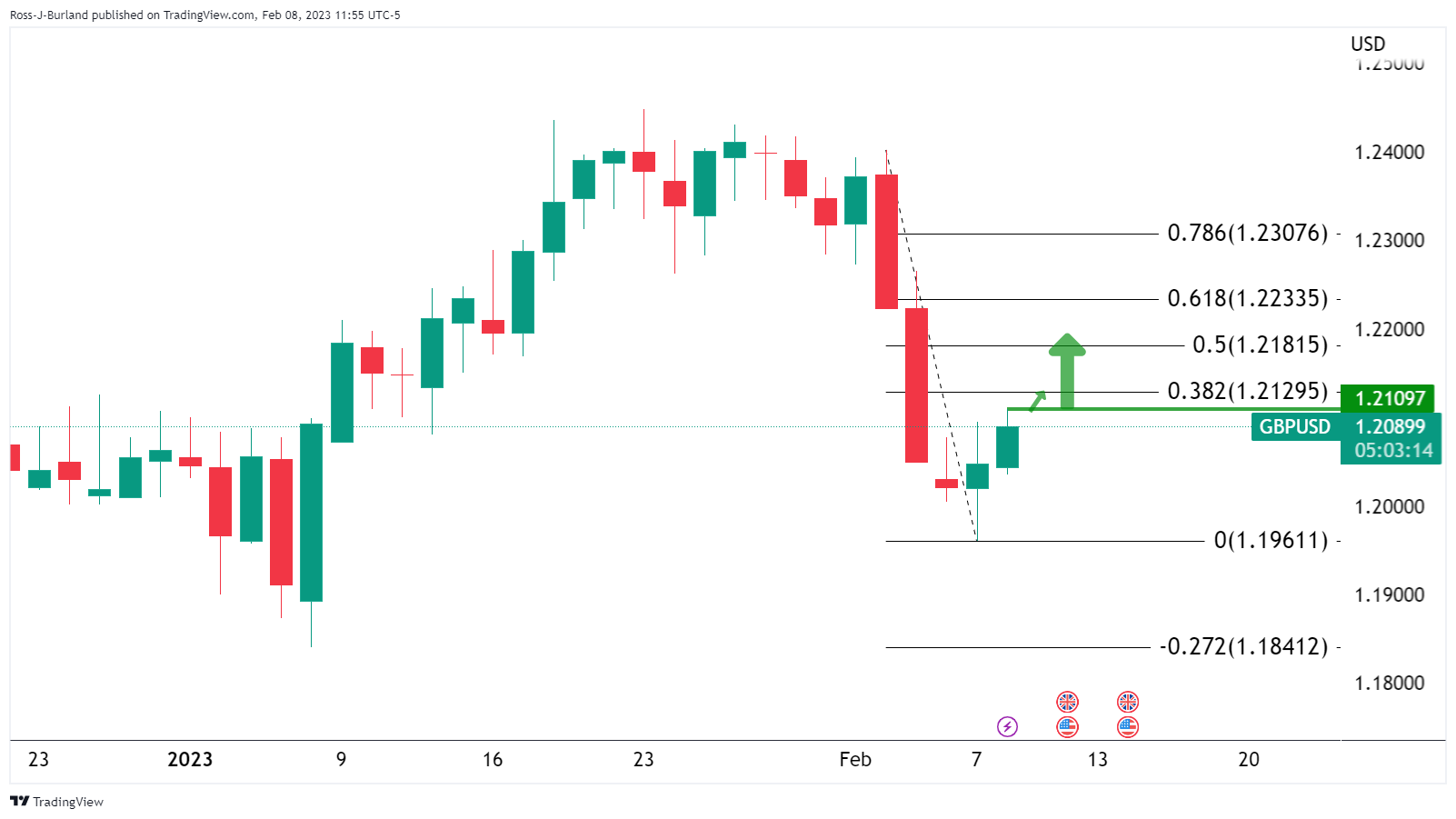

This laid the foundation for a long trade for whatever the session. Asia was a sideways session, setting the stage for an explosive move higher in the London session, as GBP/USD rallied from a low of 1.2037 to a high of 1.2109.

GBP/USD, now what?

The question is whether there is anything left in the tank for the bulls in the US session. For the day to close higher, which was yesterday’s thesis, the price must close above Tuesday’s closing price of 1.2046. The daily ATR is 122 points and so far this day the range has been between 1.2030 and 1.2109, 79 points. This leaves more room to the upside if the daily ATR low of around 1.2250 is to be reached.

Looking for a bullish setup on Tuesday, 1.2180 was sought on a 50% mean reversion target. Along the way, the 38.2% Fibonacci retracement came in at 1.2129, which remains vulnerable for today and certainly the rest of the week:

In the 15-minute chart, the price is breaking the structure after recording a higher low in the American session. A break of 1.2092 is now what the bulls need to cement the prospects for a late-day push to the 38.2% Fibonacci level target around 1.2120:

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.