- GBP/USD bulls may be getting tired at this point.

- The bears need to break the 1.2140 structure to consolidate the downtrend for today.

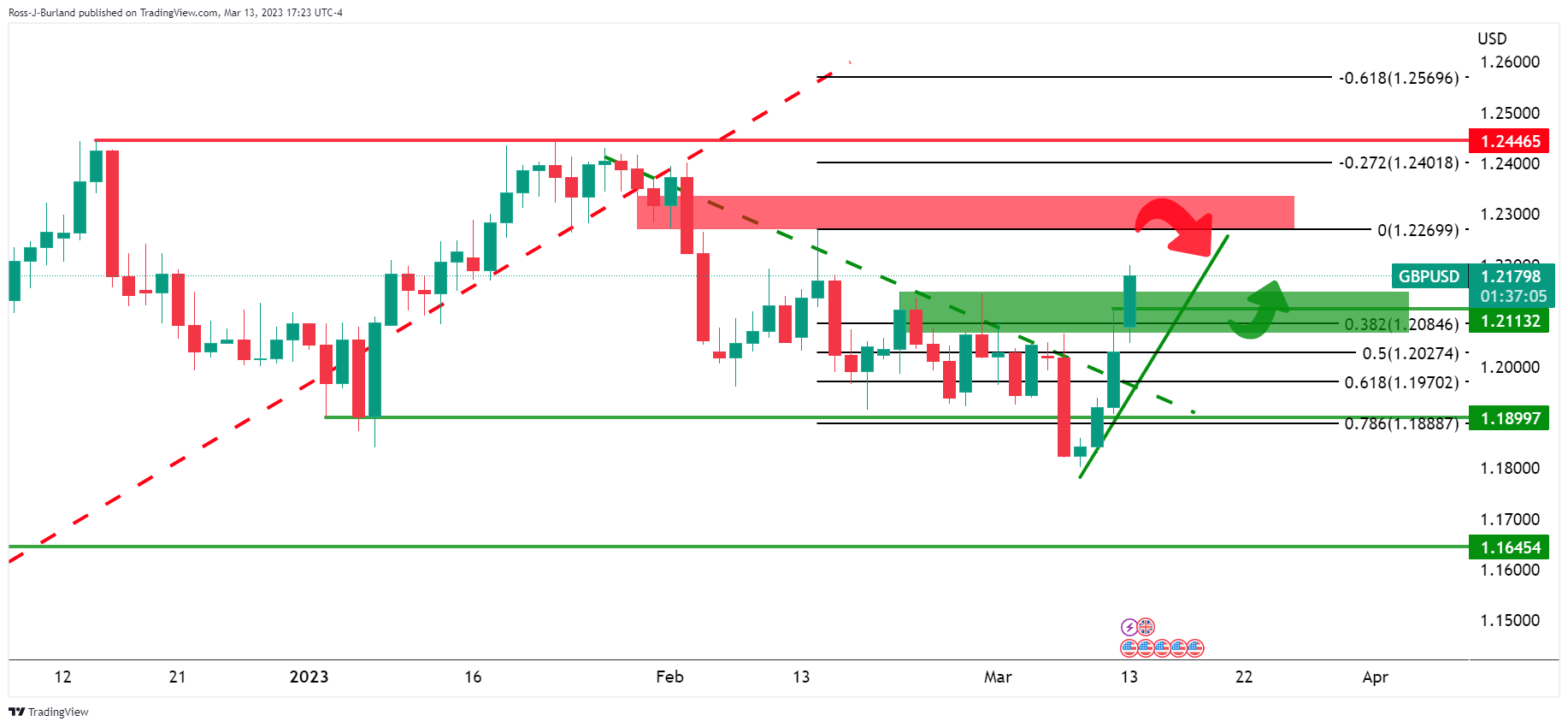

He GBP/USD it has approached a potential resistance zone on the daily chart, as shown below. This raises the prospect of a significant correction over the next week:

Drawing the Fibonacci from a presumed level where there could be resistance if the price continued higher over the next day or so, a 38.2% fibonacci retracement level appears near 1.2080 as potential support.

At this point, however, the Fibonacci retracement from the current highs, 38.2%, sits at 1.2050.

GBP/USD 4-hour chart

On the 4 hour chart, a rally could occur to test 1.2200-1.2250, but a subsequent failure and microdynamic support break will likely set the stage for the expected correction.

GBP/USD 1 hour chart

Meanwhile, the price remains well ahead of the trend. However, the hourly micro trend line is now under some pressure adding substance to the corrective trend at this time. A break of the 1.2140 structure is needed to consolidate the downtrend for tomorrow.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.