- GBP/USD rebounds in the American session ahead of the Fed’s meeting with Powell.

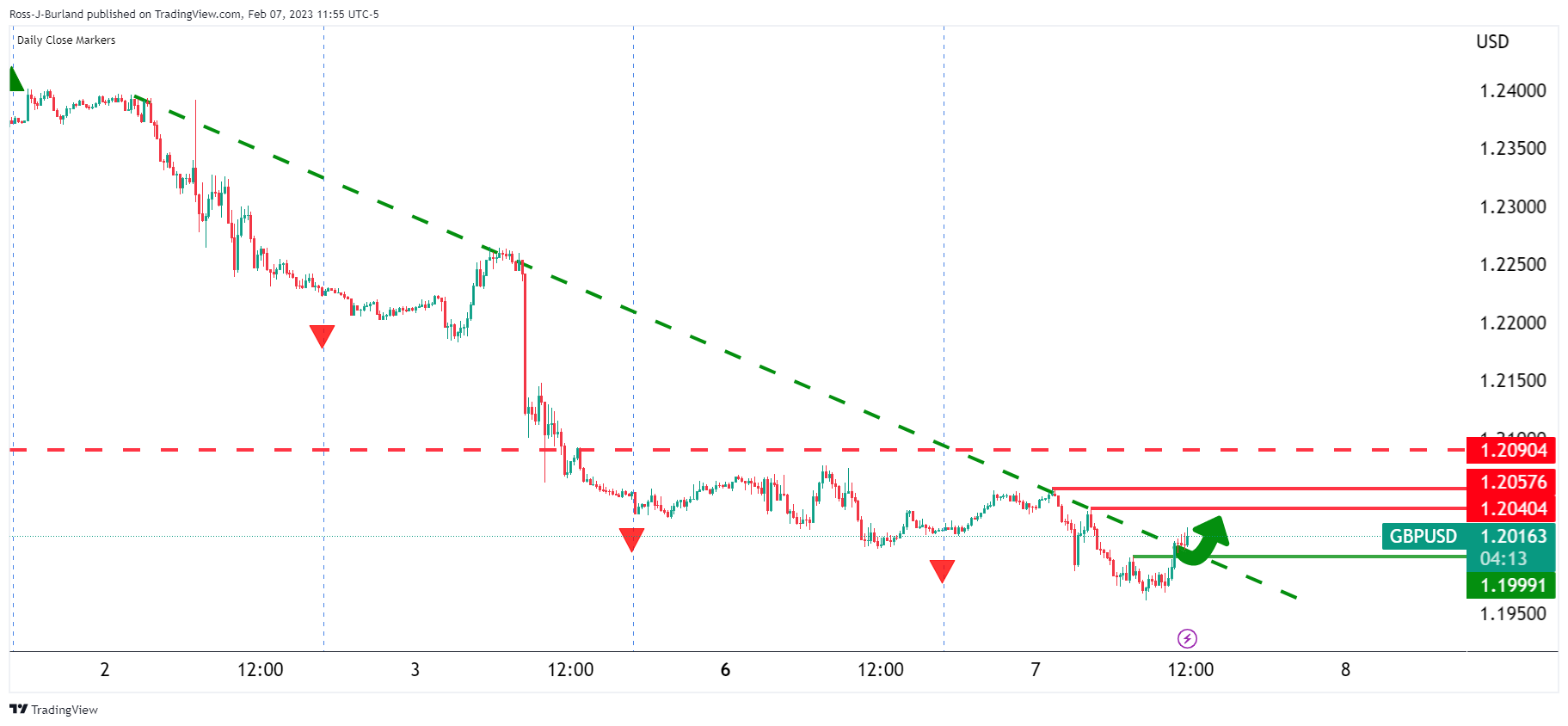

- GBP/USD is behind trend line resistance, which is now expected to act as a counter trend line with an upside focus.

- There are prospects for a move towards 1.2050 with 1.1990 as support.

He GBP/USD it is breaking through the 1.20 level and the bulls are targeting 1.2050 for the next few sessions. The pound has traveled between a low of 1.1960 and 1.2057 on Tuesday.

The US dollar lost some ground in the London session, driving the pound to fresh session highs in, entering the 50% London session sell-off, in a move ahead of a key speech Federal Reserve Chairman Jerome Powell. There will be other members of the Fed, as well as the start of the redemption auctions with the 3-year auction today.

Fed Chairman Powell will be interviewed in a live broadcast at the Economic Club in Washington, DC, beginning at 6:00 p.m. CET. ”This could give Powell a chance to blunt the very dovish markets’ reaction to his press conference last week if he wants, especially in light of the strong jobs report and ISM data we’ve seen since then.” ‘, explain Danske Bank analysts.

For its part, the United Kingdom’s Monetary Policy Committee recently raised its interest rate by 50 basis points, to 4.00%, in line with the consensus, but above our forecast of a 25 basis point rise. The vote was split 7-2, with the two members voting against it and preferring no change to the Bank Rate. However, the Bank of England is now data dependent and with inflation expected to be significantly lower by the end of the year and prospects for an increase in the unemployment rate, there are downside risks to the pound in case the BoE changes the script.

However, this week Catherine Mann, a hardline member of the Bank of England’s Monetary Policy Committee, said that “the consequences of insufficient tightening far outweigh the alternative, in my opinion.” We need to stay the course and the next move in bank rates is still more likely to be another hike than a cut or hold in my view.” In fact, the BoE speakers are plentiful this week and we’ve also heard from the economist Chief Huw Pill who said: ”If you ask me where we are at the moment, I think we remain more concerned about the possible persistence of inflation.”

Concerns about inflationary pressure in the labor market “probably inclines us to say that we have not reached the point where we have confidence to engage in a rate turning point debate.”

GBP/USD Technical Analysis

Based on analysis earlier in the week, which showed GBP/USD having closed lower for three consecutive days, a move to the upside was expected:

However, as the illustration above suggested, bears could be on the lookout for a move higher to test the breakout of the BoS area near 1.2090.

In the meantime, we are starting to see the bulls move on schedule:

We are on the back of trend line resistance, which is now expected to act as a counter trend line with an upside focus. There are prospects for a move towards 1.2050 with 1.1990 seen as support.

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.