- GBP/JPY is a tricky mix between USD/JPY and GBP/USD.

- There are prospects for a move higher in GBP/JPY based on the bullish pennant, but bears are lurking.

According to the above analysis on the yen, USD/JPY Price Analysis: The Bullish fundamentals join a technically bullish chartthe Japanese currency has weakened and this is being reflected in crosses such as the GBP/JPY.

USD/JPY daily chart, before and after

As seen, the yen fell and USD/JPY is above some old resistance. However, the W formation is a sp reversal pattern that could keep the pair paralyzed, stalling the advance. Furthermore, Kazuo Ueda has been surprise-elected as the next Bank of Japan governor and market rumors suggest that he is more pragmatic than hawk or dove.

In the meantime, the following illustrates the downtrend at the moment, taking into account the rally in the pound and the fall in the yen.

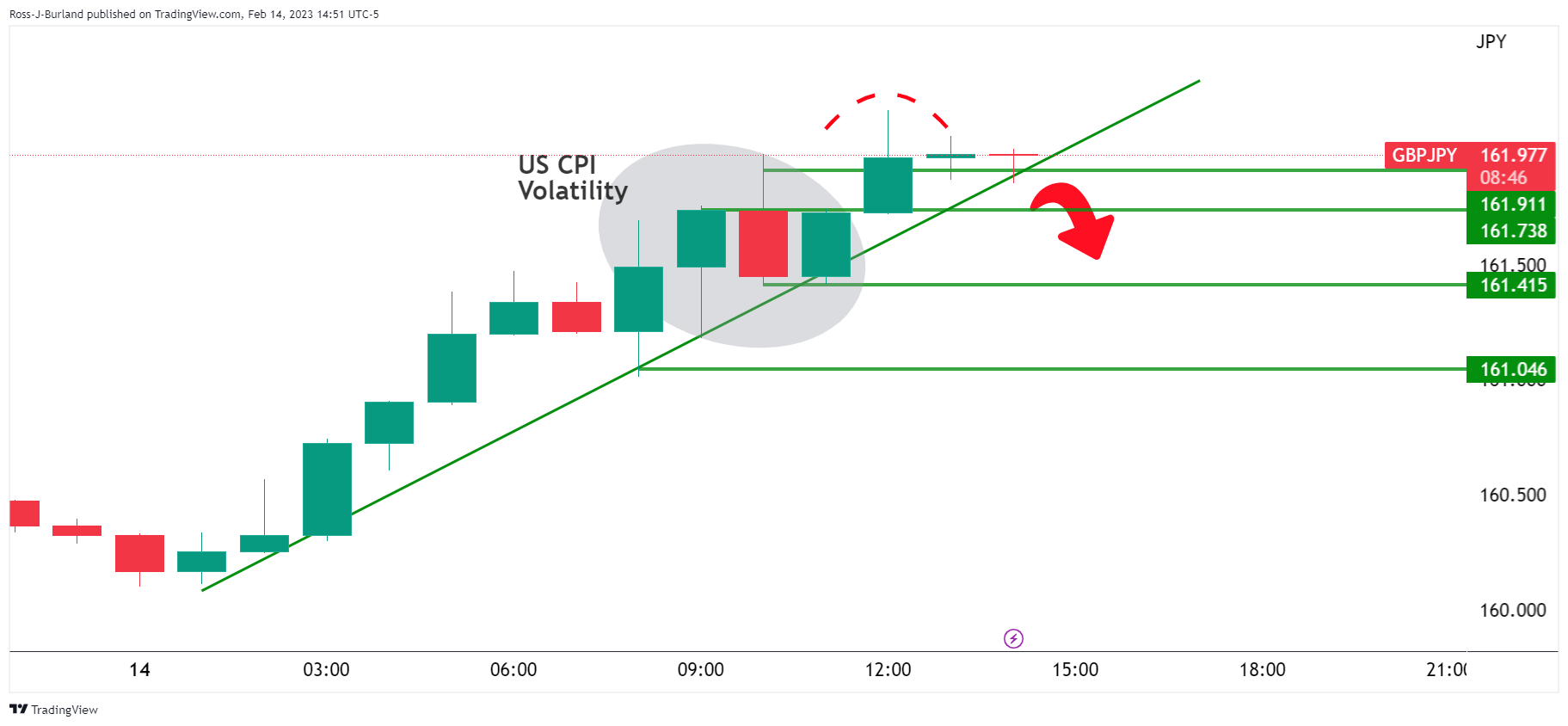

GBP/JPY H1 chart

A break of trend line support opens the risk of a move below 162.00.

GBP/JPY M15 chart

We have a potential top pattern, but the price has to close sharply lower or else it can be considered a bullish pennant:

The 78.6% Fibonacci near 161.50 could be the trapdoor the bears will want to breach to invalidate the bull flag thesis.

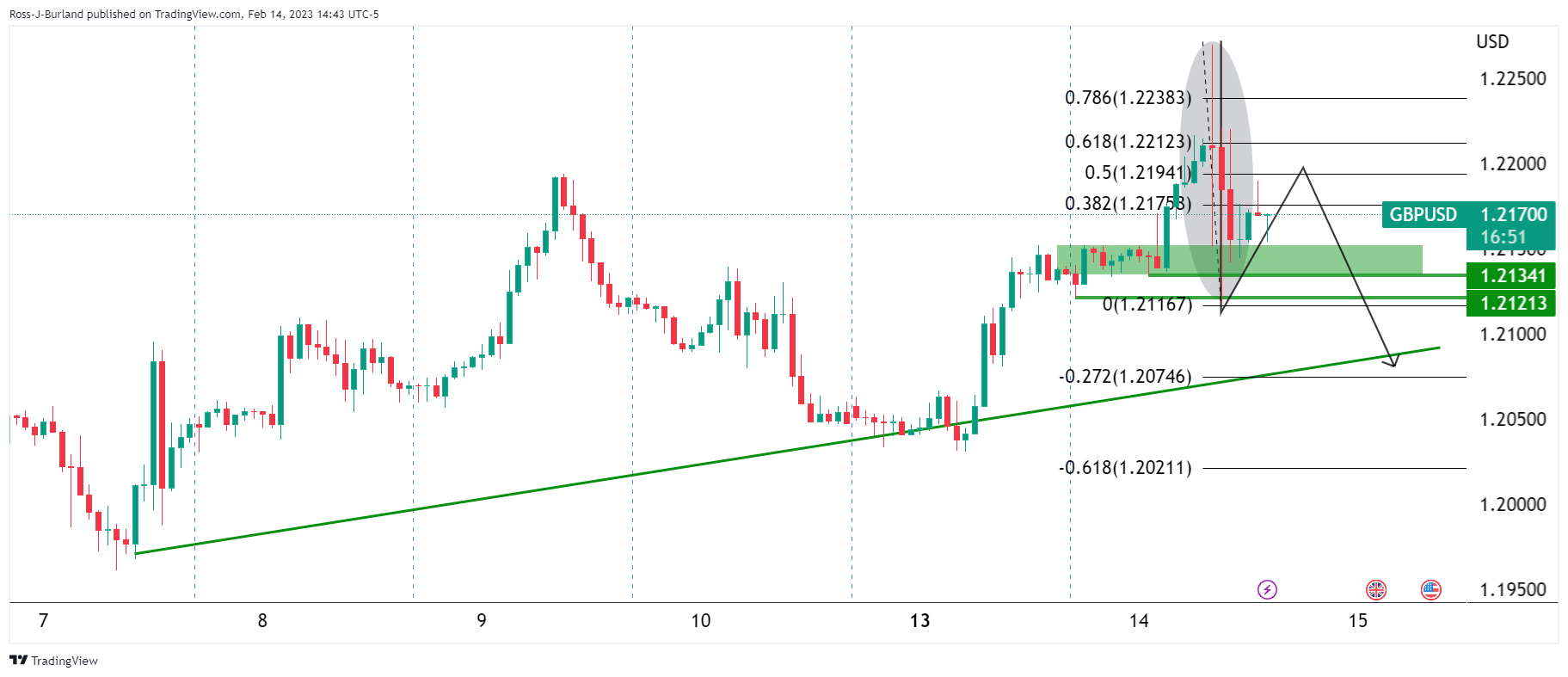

GBP/USD Price Analysis

As for GBP/USD, if the bears do commit then we could see a move below support and that could trigger a deep correction in GBP/JPY.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.