St.Louis Fed President James Bullard made a series of remarks, indicating that market-based inflation expectations are “now relatively low” and that the economy is growing faster than previously thought, with unemployment below the long-term rate and output above its potential.

He said inflation “is still too high” but noted that it has come down recently and a “disinflationary” process has begun that could continue with further Fed rate hikes.

“Continued rate hikes may help set a disinflationary trend through 2023, even with continued growth and strong labor markets, keeping inflation expectations low.”

US dollar update

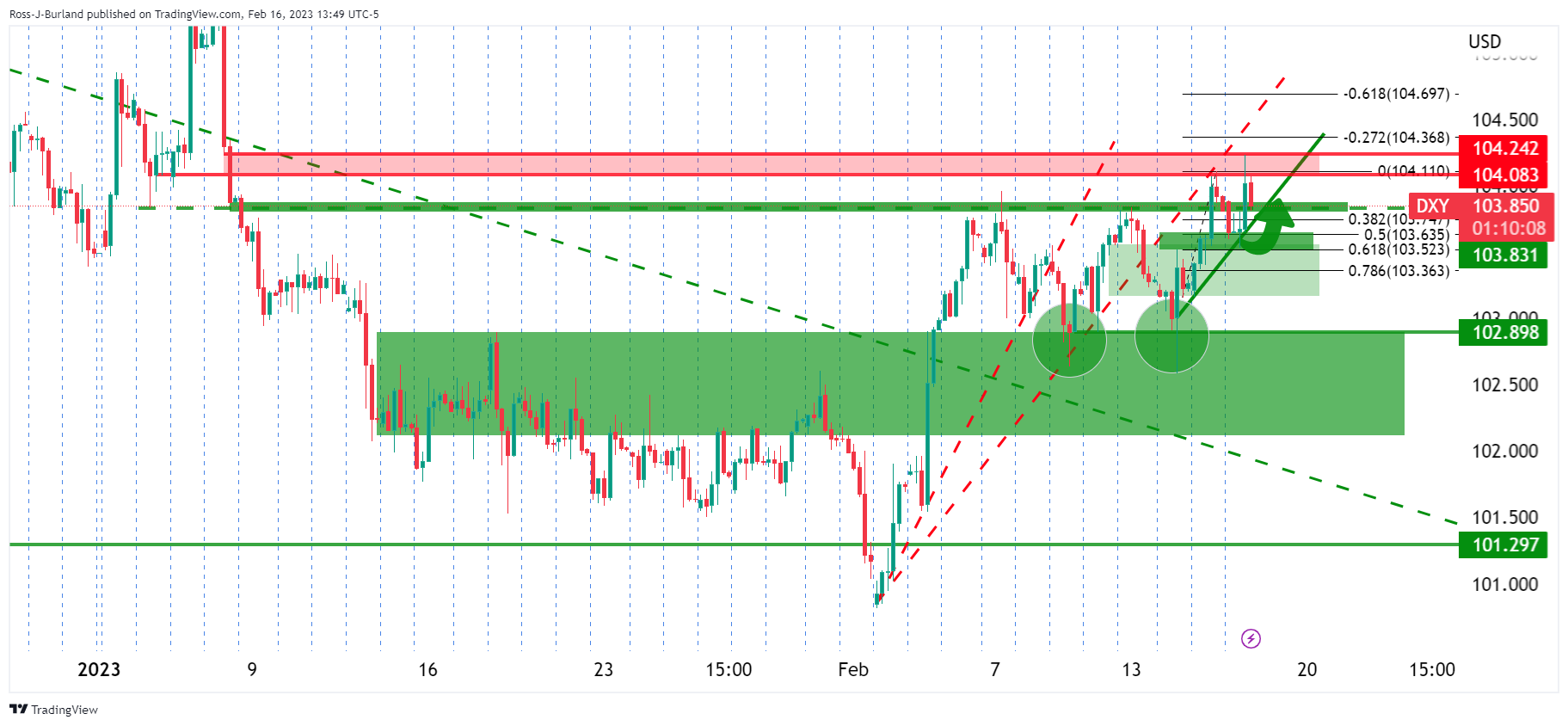

As the above analysis illustrates, the US dollar, measured against a basket of currencies, has been breaking higher and breaking out of resistance at the top of a geometric consolidation, albeit on the trailing of the lines of support from previous uptrends.

The dollar’s rise has been slow, and not even rhetoric and data from the steadfastly hawkish Federal Reserve have been able to free the bulls from the bears’ clutches. However, if the DXY were to close firmly above 103.65/80 this week, a rally could be considered, based on the following daily chart analysis:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.