- The EUR/USD pair has rallied a lot as traders wait for the US CPI.

- Bears are eyeing 1.0600 on the downside.

The pair EUR/USD has been testing a critical high in the midday session on Wall Street after what had been a positive start to the day for the US dollar. As of this writing, the EUR/USD pair is trading higher at 1.0727 and has gained 0.4% so far after a recovery from the Asian lows of 1.0655 within an ATR of 93 points.

Fundamentally, it all revolves around the Federal Reserve and positioning for the key data for the week ahead, the US Consumer Price Index, with Retail Sales as a sideshow the next day. The prospects for the CPI are mixed: some analysts foresee a moderate result and others an aggressive one.

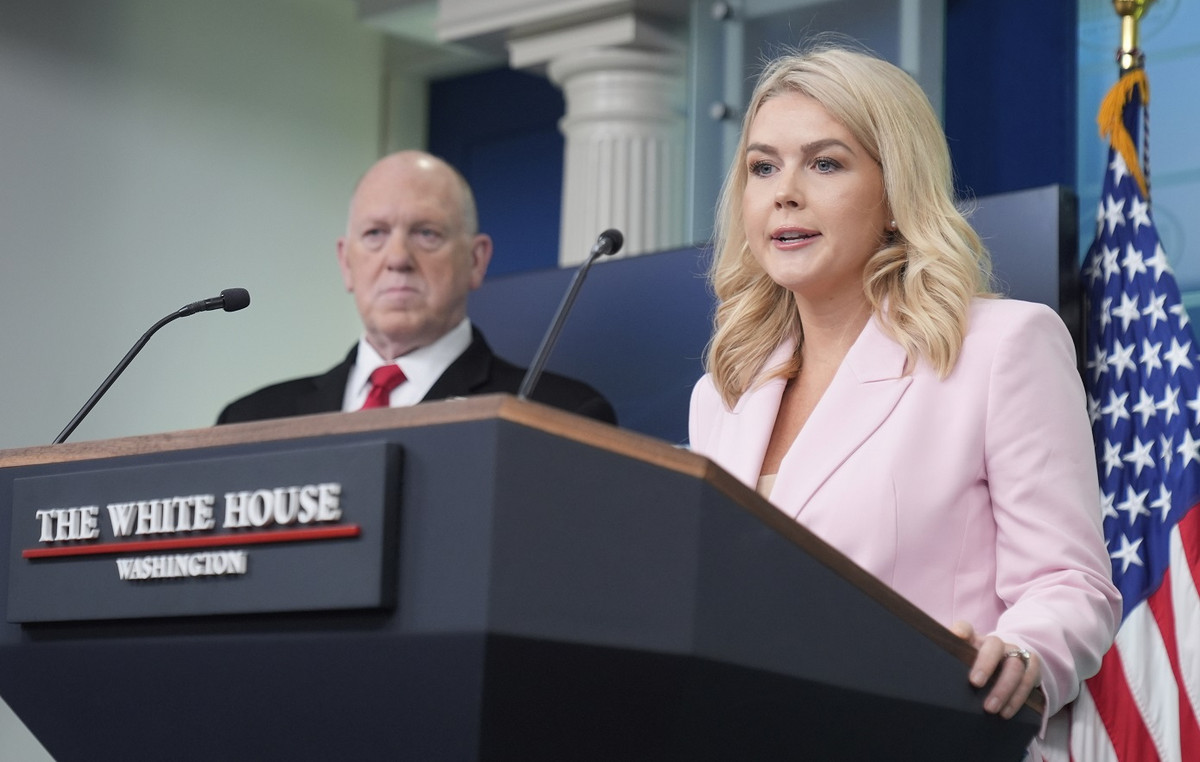

Fed spokesmen have already kicked off this week with some hawkish rhetoric. Fed Governor Michelle Bowman had this to say:

“I hope we continue to raise the federal funds rate because we have to get inflation back to our 2% target and to do that we have to better balance supply and demand,” Bowman said during an American Bankers Association conference. in Florida.

Once at a sufficiently restrictive level, interest rates will have to be maintained for “some time” to restore price stability, he added.

Bowman concluded by stating that the strength of the labor market and the moderation of inflation make possible a “soft landing” for the economy.

For their part, analysts at Brown Brothers Harriman argued that the rise in US Treasury yields of late (10-year rates rose from Thursday’s low of 3.334% to a recent high of 3.755% ) coincides with the renewed concern about inflation and the resumption of the Fed’s tightening expectations.

WIRP suggests that 25 basis point hikes on March 22 and May 3 are all but priced in, while the odds of a third hike in June or July are around 45%,” analysts say. As it may seem, the easing cycle is still expected to start in the fourth quarter, but we believe it will be corrected in the next phase of the Fed’s price review, which could come after the CPI and Producer Price Index data this week,” they said.

On the other side of the narrative, analysts at TD Securities said that ”TD anticipates a dovish CPI report this week, which underscores the prospects that recent pain trading will begin to reverse.”

The dollar’s latest correction was mainly due to extreme positioning and the short-term risk premium, which has also started to correct itself,” they noted. In addition, the strong jobs numbers did not shake the Fed, which has helped bolster The Soft Landing Speech.

The result is that if the CPI conforms to our forecasts this week, a new round of US sell-offs should start,” TD analysts say, paving the way for a bullish outlook for the euro, which is negatively correlated with US sales”.

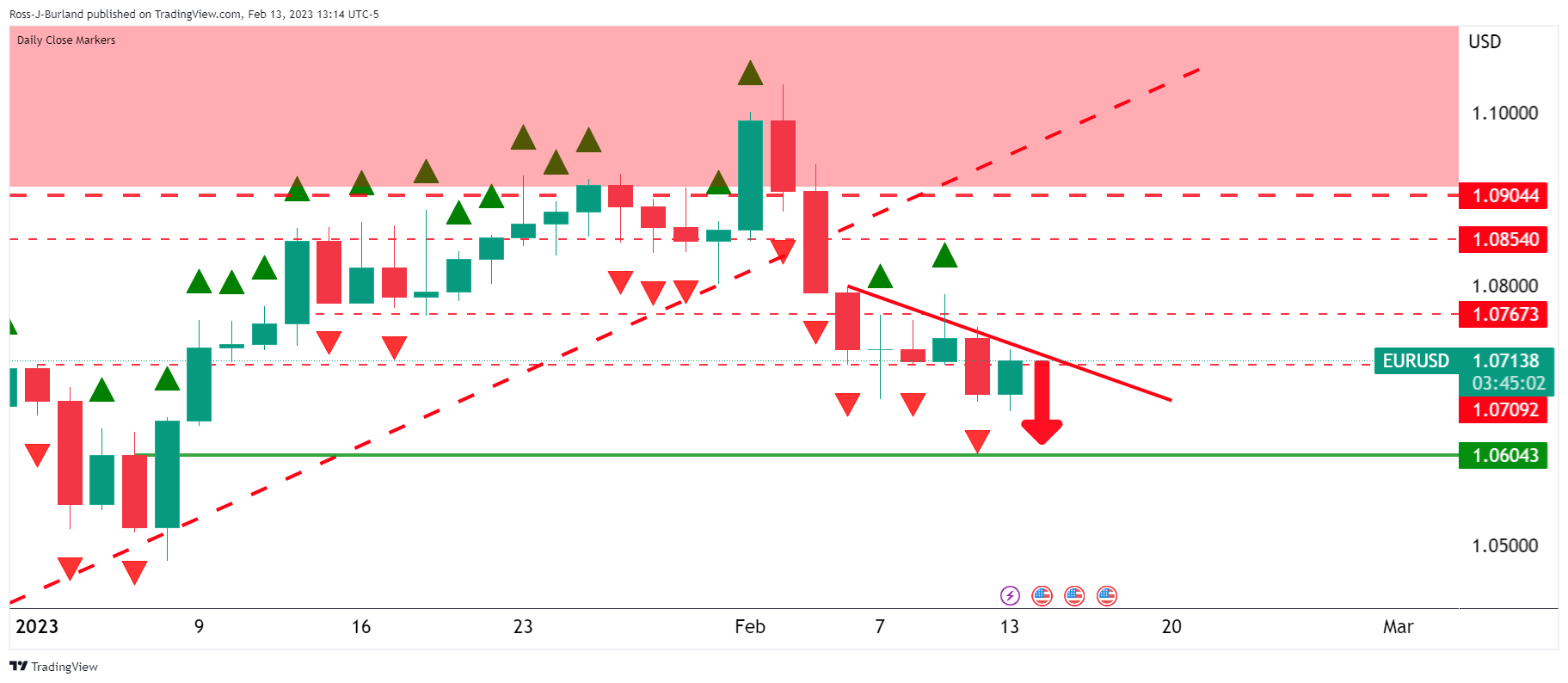

EUR/USD Technical Analysis

In the meantime, we have the key resistance on the hourly chart under test:

We have a couple of bearish BoS breakouts on Friday and the start of the week before the move higher in the shorts that had rallied over the last couple of days:

The price has broken into a new 100 point box to the upside, but this could just be a momentary pause and correction before the next major move lower.

EUR/USD daily chart

While on the front side of the trend, there are prospects for a move lower to test the 1.0600 level.

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.