- EUR/USD breaks above the 1.0700 zone, hitting almost 4-week highs.

- The dollar remains on the defensive after the publication of the NFP.

- The next event risk will be the US CPI due on Tuesday.

The EUR/USD has started Monday with a strong momentum that has led it to rise 95 pips in the Asian session, from the daily minimum 1.0642 to 1.0737, the new maximum of the last 26 days. Subsequently, the advance has lost steam and the pair has retreated below 1.0700.

EUR/USD attentive to the US CPI and the ECB

EUR/USD is advancing for the third session in a row despite the reversal of the last few hours and is trading around 1.0685, gaining 0.45% on the day.

The pair’s rebound responds to the persistent dollar sell-off, which was especially exacerbated after the mixed February payroll results released last Friday.

For its part, the dollar index (DXY) begins the week in negative territory after falling to its lowest level since February 16 at 103.68, in line with investor expectations of a 25 basis point rate hike by the Fed at its meeting on March 22, while there also seems to have been some speculation that there may not be a rate hike at this meeting.

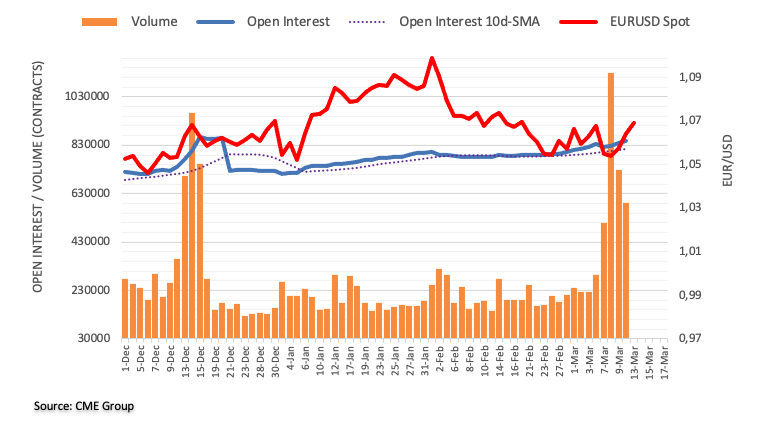

Supporting the view of a stronger EUR/USD, open interest has risen over the past three sessions, while volume has eased back to more “normal” levels following the post-Powell rally on March 7.

The absence of Eurozone data releases should leave Tuesday’s US CPI release for February as the highlight of the first half of the week. Later, at the ECB meeting on March 16, the central bank should raise the interest rate by 50 basis points.

EUR/USD Levels

The breaking of 1.0737 (March 13 monthly high) would target resistance 1.0804 (weekly high of February 14) en route to 1.1032 (2023 high recorded on February 2).

On the downside, initial support is at 1.0524 (monthly low March 8), followed by 1.0481 (2023 low of January 6) and, finally, 1.0323 (200-day SMA).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.