- EUR/USD bulls have returned to the market and are trading above 1,000.

- The bears must get involved or face more pressure on Monday.

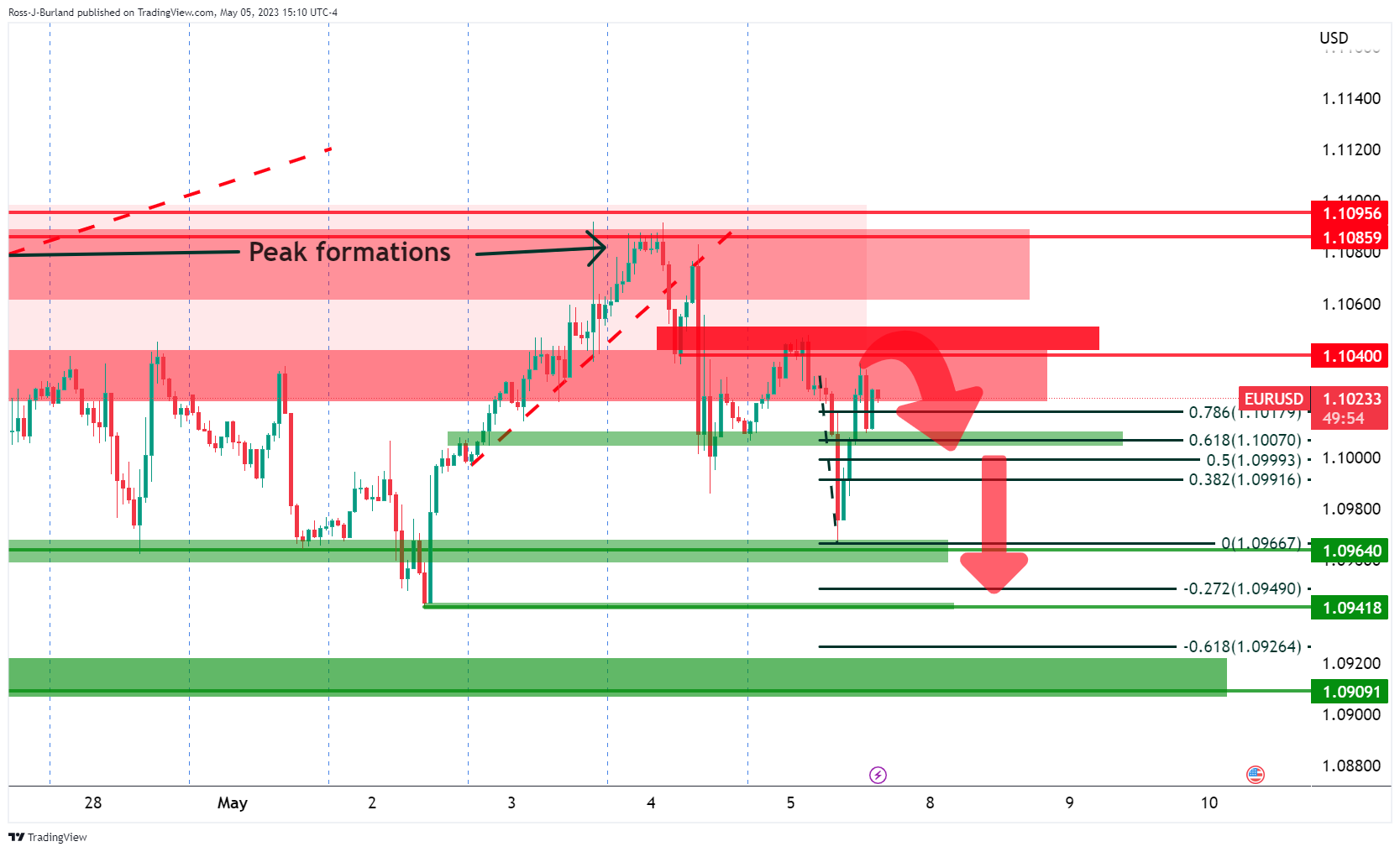

The EUR/USD pair is holding around 0.1% up and has returned to resistance, having ranged from 1.0966 to 1.1047 so far this day. The US dollar rallied early Friday after Nonfarm Payrolls data showed US employers added more jobs than expected in April. And more importantly, wages also grew above expectations.

NFP showed that there were 253,000 jobs added, well above economists’ forecasts for a gain of 180,000. US Median Hourly Earnings rose at an annual rate of 4.4%, above expectations for a 4.2% increase. However, data for March was revised down, with 165,000 jobs instead of the 236,000 that had been reported. This diluted the headline, although markets were already wrong and needed to recoup their short dollar positions, exacerbating the EUR/USD move lower.

However, the turnaround came on Wall Street, as stocks rallied and the bulls returned to the charge. EUR/USD broke above 1.1000 again and has managed to stay above the psychological number for the rest of the day. Traders continue to think that the Federal Reserve is at or near the end of its tightening cycle, which is keeping the dollar in check.

Analysts at Brown Brothers Harriman explained that “WIRP now suggests a 50% chance of a 50 basis point hike at the March 21-22 FOMC meeting, up from over 70% before SBV.” “Looking ahead, 25 basis point gains are expected in May and June, which would put fed funds between 5.50 and 5.75%.”

Analysts noted that “odds for a final 25 basis point rise in Q3 have evaporated, up from pre-SBV odds of over 30%.” Today’s strong jobs report should refocus the market’s attention on the US economy rather than the US banking system. For now, we believe the uptrend in US yields. and the dollar remains intact”.

For their part, Rabobank analysts explained that “given that new rate hikes from the European Central Bank are already discounted, the reasons to buy the euro could be running out.”

In our opinion, EUR/USD could be topping out. We see room for a move lower in the coming months, potentially towards the EUR/USD1.06 zone,” the analysts said.

EUR/USD Technical Analysis

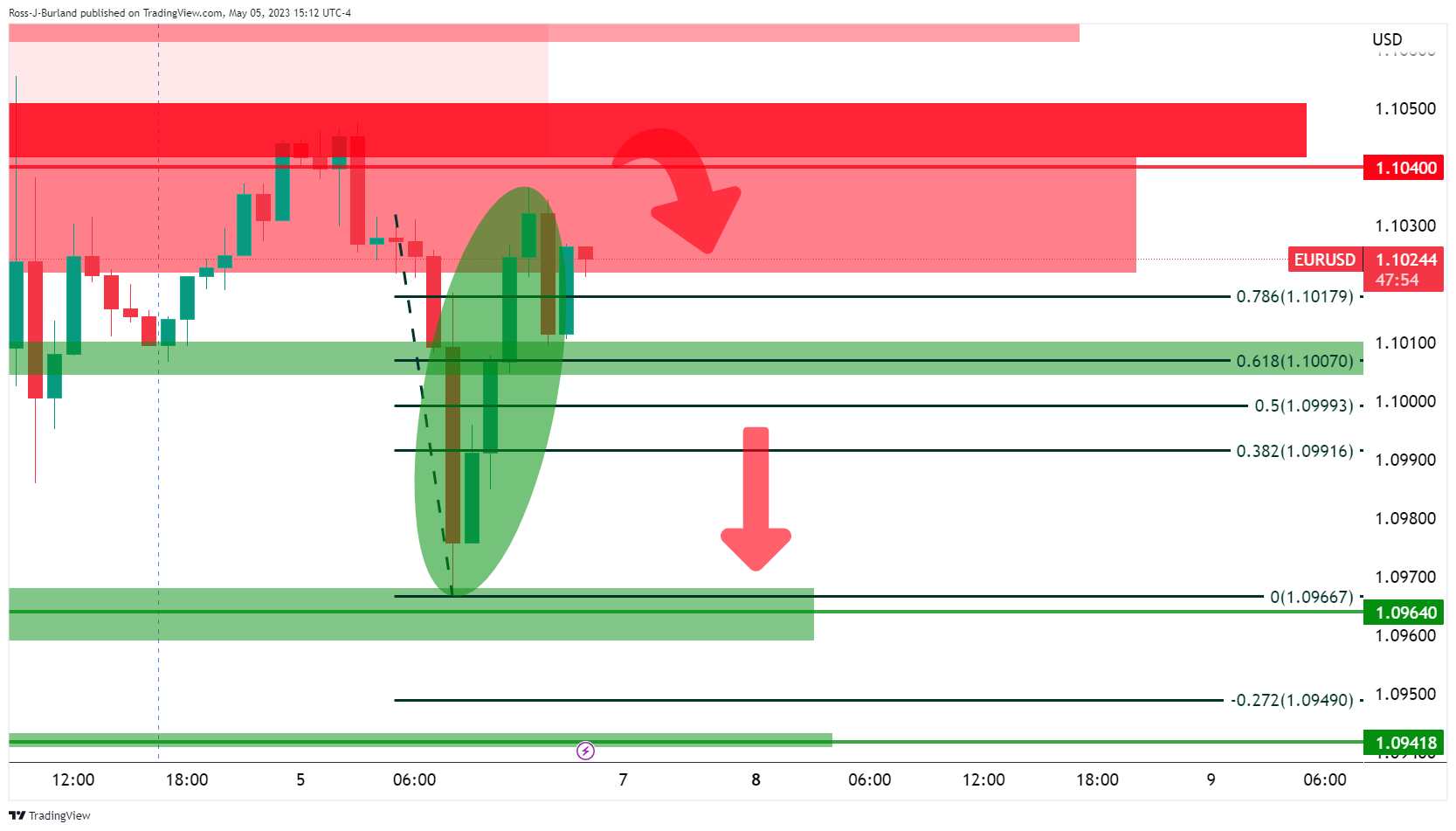

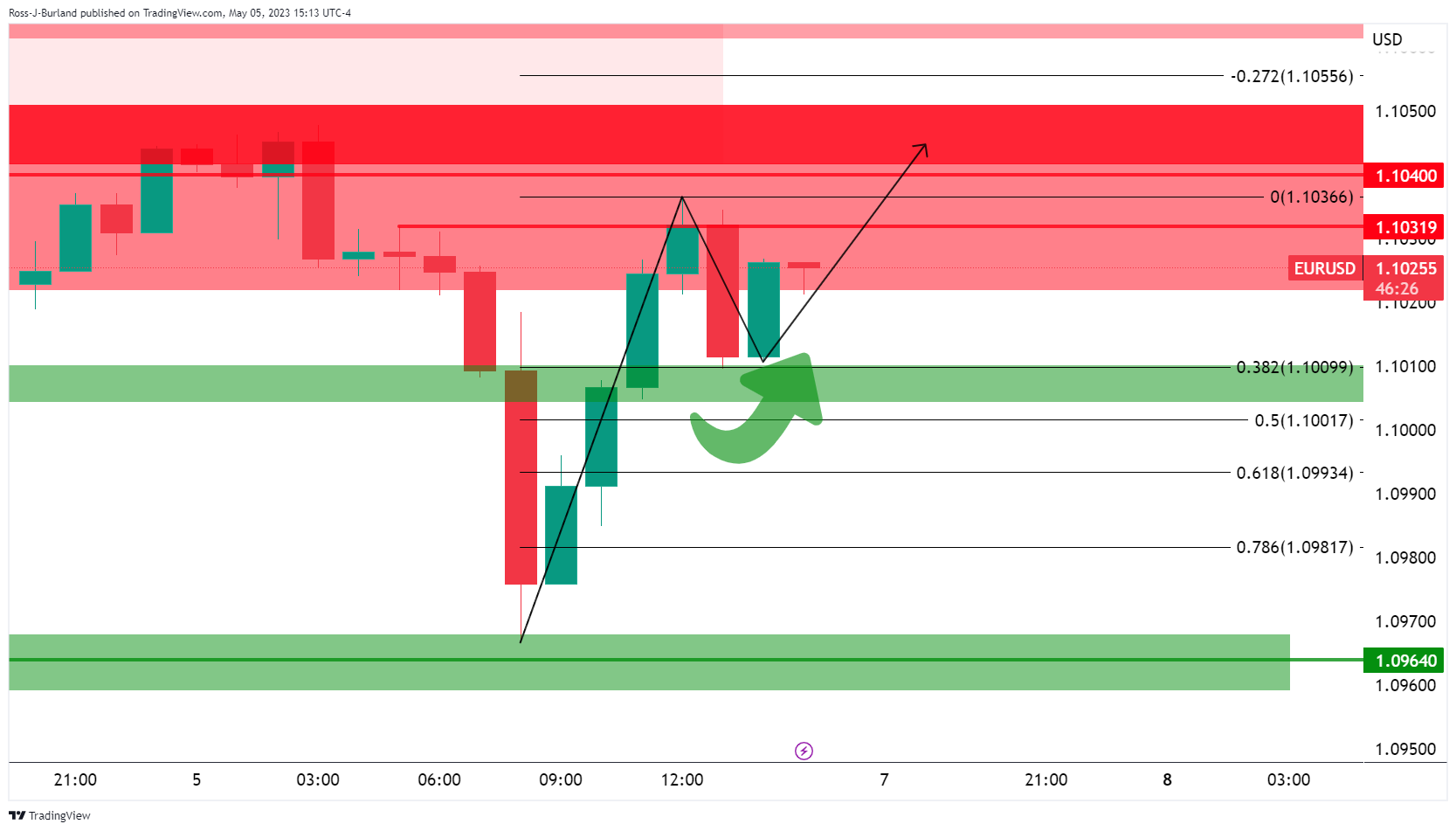

Price is finding resistance in this bearish pattern with focus on a move towards 1.0900. However, the bears have to show up at this juncture, considering that the bulls managed to break above the 78.6% ratio of the Fibonacci level on the Wall Street rally:

Bullish, at least for now:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.