- EUR/USD recovers in a weaker US labor market, with non-farm payrolls missing the target of 180,000.

- Speculation is mounting about a Fed rate cut in the second half of 2024 as hiring slows and unemployment rises.

- Despite the EU’s own economic slowdown, the Euro benefits from the general weakness of the Dollar and the reduction of rate hike bets.

The pair EUR/USD rebounded during the North American session on Friday after US data showed a weaker labor market as Non-Farm Payrolls disappointed market expectations. Traders therefore reduced the chances of another Fed rate hike; instead, they expect cuts for the second half of next year, a headwind for the US Dollar (USD). The main pair is trading at 1.0726, with a gain of 1%.

EUR/USD takes advantage of dollar weakness after disappointing non-farm payrolls, which point to a pause in the Fed’s rate hike

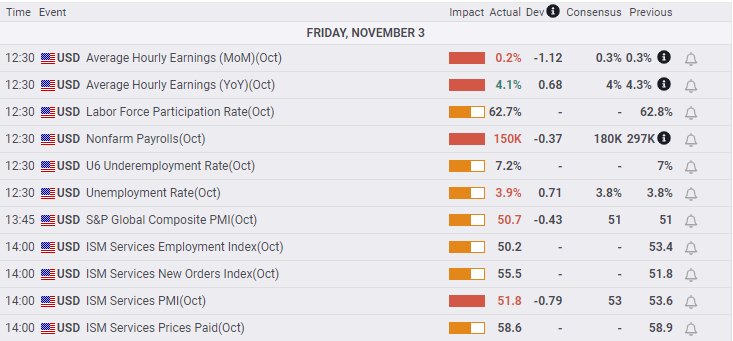

The US dollar continues to weaken as the US Department of Labor showed that the labor market is cooling as hiring slowed, non-farm payrolls data revealed. In October, the economy added 150,000 jobs, but missed forecasts of 180,000 and fell short of the 290,000 jobs added to the labor force in September. This, along with rising unemployment rates and average hourly earnings, sparked speculation that the Fed is done raising rates.

Furthermore, S&P Global and the Institute of Supply Management (ISM) revealed that the services PMI exceeded the contraction/expansion threshold of 50, although at a brisk pace of decline towards the 40 area.

All that said, the Federal Reserve’s decision last Wednesday to hold rates is justified, as market participants seem convinced that further rate hikes are not necessary. Despite Fed Chairman Jerome Powell’s hawkish comments. As a result, Wall Street rallies, the dollar plummets, and US bond yields fall.

US economic data for Friday

On the data front, the Eurozone (EU) economic calendar showed that business activity in the bloc is slowing amid a high inflation environment, reigniting stagflation issues. Therefore, money market futures estimate that the European Central Bank (ECB) has ended its tightening cycle, which would likely weaken the Euro, but broad US Dollar weakness underpins the EUR/USD pair.

EUR/USD Price Analysis: Technical Outlook

From a technical perspective, EUR/USD’s bearish bias is intact as the pair is testing the top of a bearish flag. Breaking above the 1.0750 area could expose the 1.0800 figure, with the 200-day moving average (DMA) next at 1.0810. Conversely, sellers could regain control if they push prices below the October 24 high at 1.0694, putting bearish pressure on the pair.

EUR/USD

| Overview | |

|---|---|

| Latest price today | 1.0736 |

| Daily change today | 0.0114 |

| Today’s daily variation | 1.07 |

| Today’s daily opening | 1.0622 |

| Trends | |

|---|---|

| daily SMA20 | 1,058 |

| daily SMA50 | 1.0639 |

| SMA100 daily | 1.0809 |

| SMA200 daily | 1.0808 |

| Levels | |

|---|---|

| Previous daily high | 1.0668 |

| Previous daily low | 1.0566 |

| Previous weekly high | 1.0695 |

| Previous weekly low | 1.0522 |

| Previous Monthly High | 1.0695 |

| Previous monthly low | 1.0448 |

| Daily Fibonacci 38.2 | 1.0629 |

| Fibonacci 61.8% daily | 1.0605 |

| Daily Pivot Point S1 | 1,057 |

| Daily Pivot Point S2 | 1.0517 |

| Daily Pivot Point S3 | 1.0468 |

| Daily Pivot Point R1 | 1.0671 |

| Daily Pivot Point R2 | 1,072 |

| Daily Pivot Point R3 | 1.0772 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.