- EUR/JPY falls to 160.86, reacting to rumors that the Bank of Japan could end negative interest rates.

- Technical analysis indicates a possible pullback if the pair closes below the 161.31 Kijun-Sen level.

- The recovery above 161.00 could signal a rebound towards the 162.00 mark, with an eye on the March 7 high.

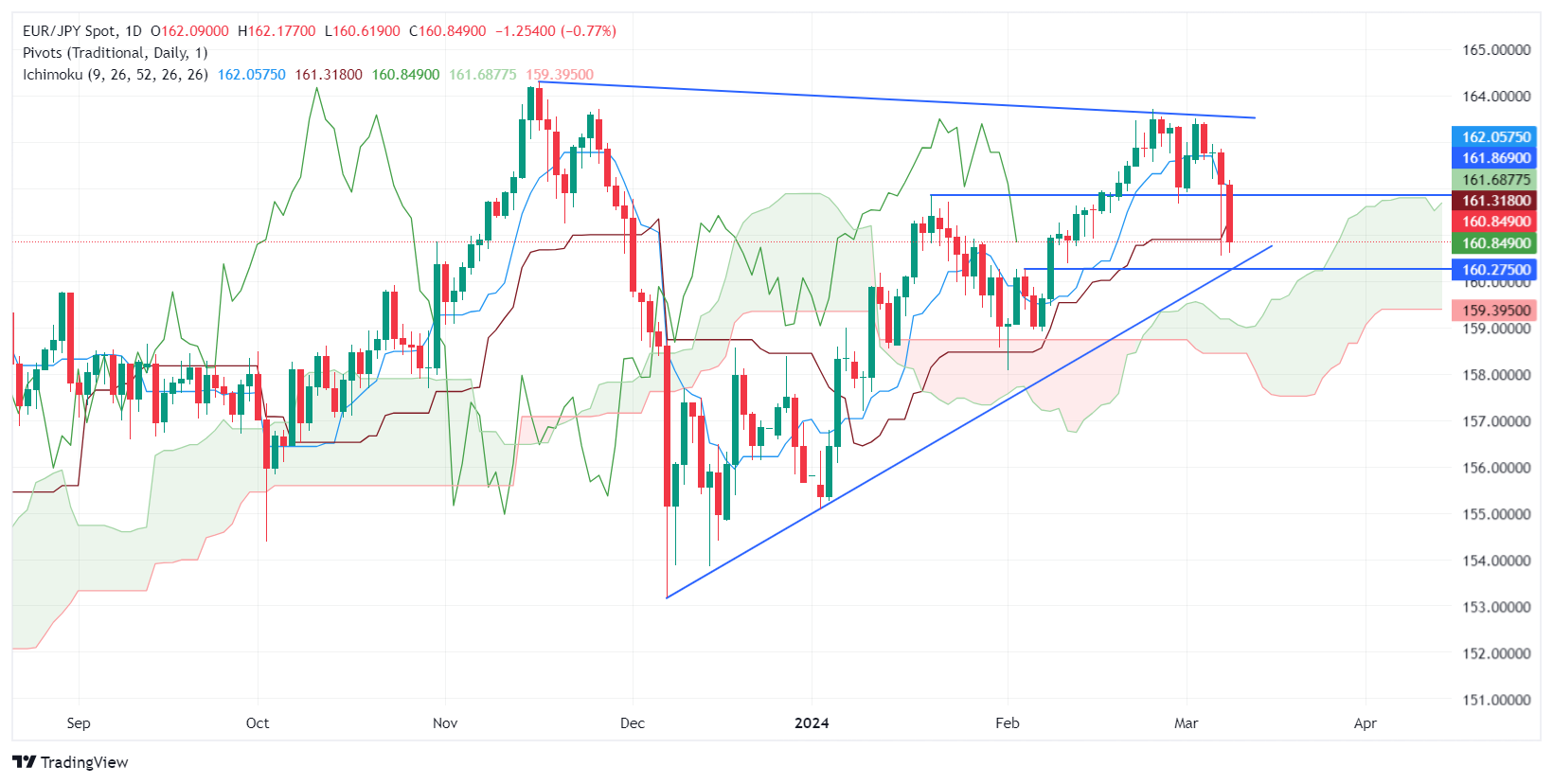

The EUR/JPY pair falls for the second consecutive day, losing 0.64% in early trading of the North American session. Rumors are growing that the Bank of Japan (BoJ) could end negative rates, leading to a rise in the Japanese yen (JPY) against most G7 currencies. At the time of writing, the pair is trading at 160.86.

EUR/JPY Price Analysis: Technical Outlook

Despite hitting a three-week low, the EUR/JPY pair is slightly tilted higher. However, if sellers achieve a daily close below the Kijun-Sen at 161.31, this could pave the way for a deeper pullback. Next support would be the psychological figures at 160.00, followed by the Senkou Span B at 159.39 and the top of the Ichimoku (Kumo) cloud around 159.00/15.

On the other hand, if buyers push the exchange rate above 161.00 and recover the Kijun-Sen, a rise towards 162.00 could occur. Once surpassed, the 162.00 level would have to be tested in the currency market. Once this area is overcome, we will have to wait for the March 7 high at 162.81 to be tested.

EUR/JPY Price Action – Daily Chart

EUR/JPY

| Overview | |

|---|---|

| Latest price today | 160.91 |

| Daily change today | -1.19 |

| Today's daily variation | -0.73 |

| Today's daily opening | 162.1 |

| Trends | |

|---|---|

| daily SMA20 | 162.32 |

| 50 daily SMA | 160.49 |

| SMA100 daily | 160.02 |

| SMA200 Journal | 158.28 |

| Levels | |

|---|---|

| Previous daily high | 162.85 |

| Previous daily low | 160.56 |

| Previous weekly high | 163.72 |

| Previous weekly low | 161.68 |

| Previous Monthly High | 163.72 |

| Previous monthly low | 158.08 |

| Daily Fibonacci 38.2 | 161.43 |

| Fibonacci 61.8% daily | 161.97 |

| Daily Pivot Point S1 | 160.82 |

| Daily Pivot Point S2 | 159.54 |

| Daily Pivot Point S3 | 158.53 |

| Daily Pivot Point R1 | 163.12 |

| Daily Pivot Point R2 | 164.13 |

| Daily Pivot Point R3 | 165.41 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.