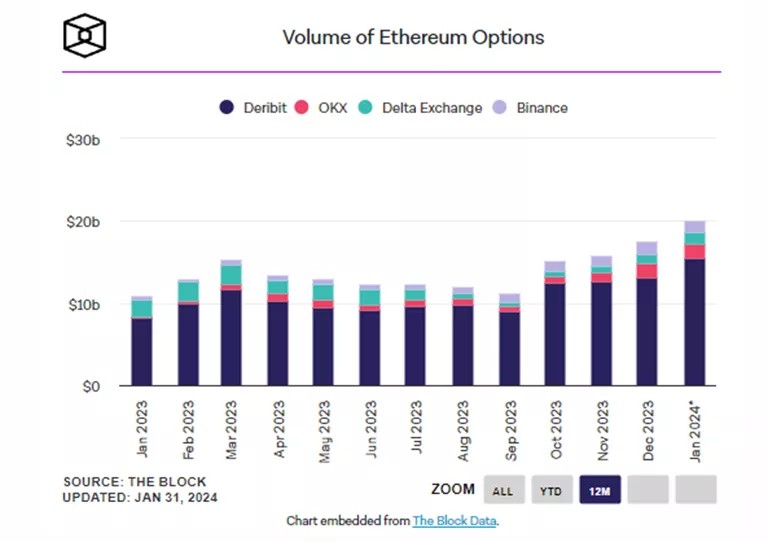

In less than a month of January, the trading volume of Ethereum options reached a record ~$20 billion. Such data is contained in the dashboard The Block.

Three quarters of this value came from the Deribit platform.

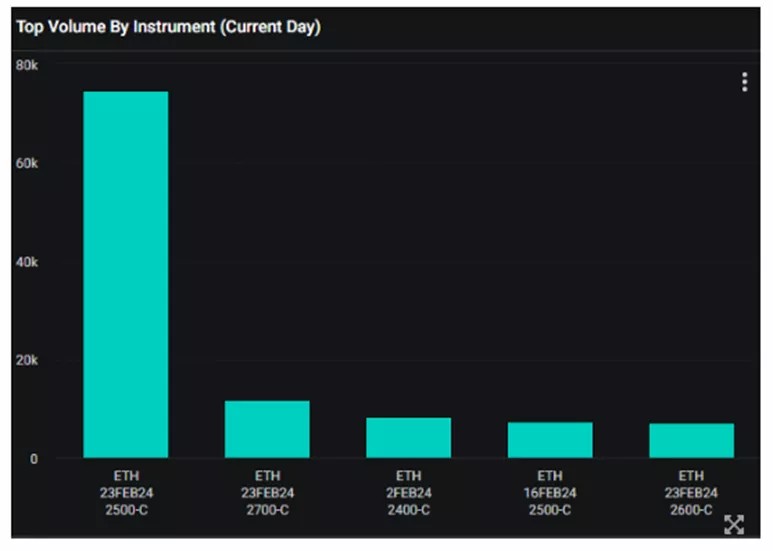

The most activity was concentrated in call options with an exercise price of $2,500 on February 23. Open interest in them reached 74,548 contracts with a nominal value of ~$172 million.

In other words, a significant portion of traders expect Ethereum to break above $2,500 within the next 24 days.

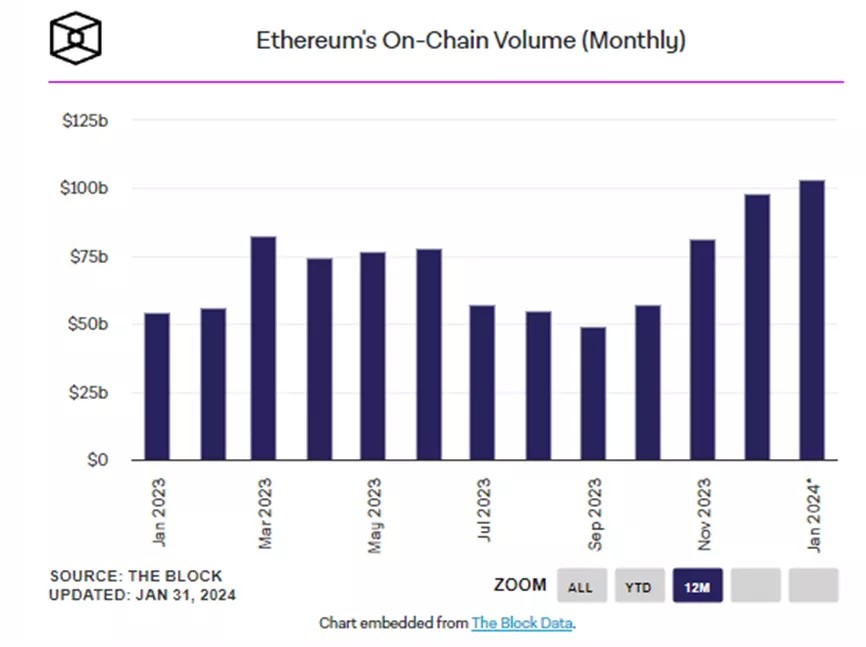

The publication drew attention to the increased activity in the blockchain of the second largest cryptocurrency by capitalization.

Since the beginning of the year, the volume of transactions has reached the equivalent of $102.9 billion. The figure for partial January exceeded the December value ($97.8 billion) by 5%. The metric is significantly higher than levels observed in 2023 and the second half of 2022.

Standard Chartered predicted that Ethereum will rise to $4,000 due to the expected approval of a spot ETF based on it. Analysts also mentioned the upcoming Denсun update as a potential driver.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.