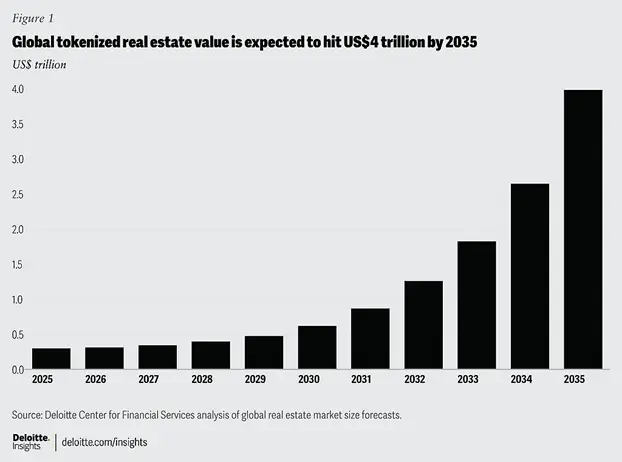

According to analysts, through the use of blockchain technologies and the development of tokenized assets of the real world (RWA), such as land, loans or investment funds, the market can grow with an annual pace of 27%-from the current $ 300 billion.

Tokenization will provide organizations with the opportunity to solve the problems of inefficiency of work and high administrative expenses for investors.

“Tokenization, which was once a niche experiment, can soon become the basis of the new financial infrastructure in the field of real estate. The technology can help create trillions of dollars of economic activity in this market over the next decade, ”the Deloitte specialists report.

According to experts, the main growth will have to be on:

-

tokenized debt securities – $ 2.39 trillion;

-

Private real estate funds – $ 1 trillion;

-

Building projects or undeveloped land plots – $ 500 billion.

At the same time, the market is faced with several problems, in particular, with the legislative uncertainty of various jurisdictions and the lack of intelligible scenarios in the case of default, experts emphasized.

Earlier, the National Commission on Digital Assets of Salvador (CNAD) in cooperation with the American law firm Perkin Law Firm and former partner of Goldman Sachs Bank Heather Shemilt Offered US Securities and Exchange Commissions (SEC) create a single sandbox for shares tokenization.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.