The Compound community, in an effort to protect against the risk of low-liquid tokens, has voted to set a borrowing limit for non-stablecoin assets.

Crypto lender Compound, according to the updated v2 protocol, will introduce credit limits for ten tokens at the end of November to reduce the amount of collateral that users can borrow. The vote was based on a proposal from the Compound DAO’s DeFi risk management protocol Gauntlet.

Gauntlet offer

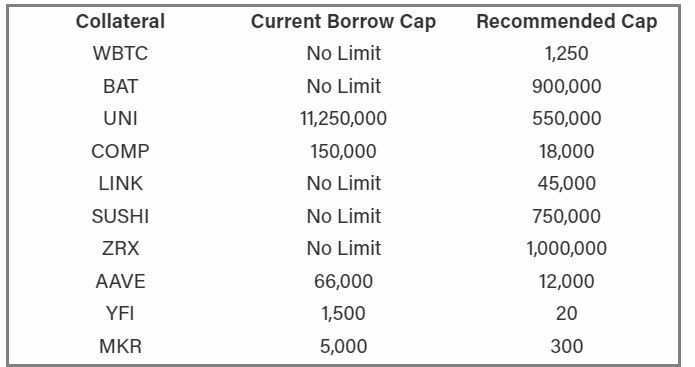

urged set borrowing limits on certain collateral assets. This move was to adjust the risk parameters of Compound v2. The list of collateral assets includes Compound native token (COMP), wrapped Bitcoin (WBTC) and Uniswap (UNI), SushiSwap (SUSHI), Aave (AAVE) MakerDAO (MKR) token. These assets will have borrowing limits on Compound v2.

Half of these tokens, including WBTC and SUSHI, previously had no borrowing restrictions. The Gauntlet team explained that the limit would reduce the impact of high-risk attack vectors.

As an example, they cited DeFi Aave with $1.6 million in bad debt that arose from a short position in the CurveDAO (CRV) token. Not everyone in the Compound community agreed with the Gauntlet plan. Some community members have argued that imposing borrowing restrictions could reduce Compound’s competitiveness in the DeFi market.

Recently, the Aave lending protocol announced that it was freezing 17 tokens due to low liquidity.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.