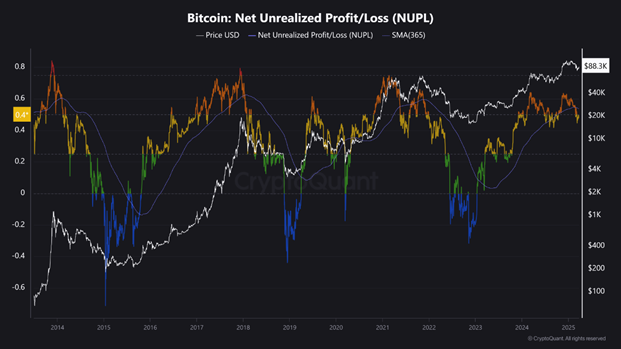

According to analysts, metric Bitcoin IFPindicator Bitcoin CQindicator of the ratio of market capitalization to realized (MVRV) and metric of unrealized net income (NUPL) indicate a probable significant decrease in the value of the asset:

“All these metrics indicate that Bitcoin experiences significant turbulence in the short and medium term. However, none of them mean that the asset has reached an overheated or cyclic level. ”

Cryptocurrency price fluctuations reflect a wider context of the market uncertainty, Cryptoquant analysts believe. If macroeconomic conditions change for the better, Bitcoin has a chance to overcome an important support level of $ 84,000.

Earlier, Glassnode experts said that large bitcoin holders, on the account of each of which are more than 10,000 BTC, are actively accumulating the first cryptocurrency – since March 11, the balance of such cryptocurns increased by 129,000 BTC.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.