Bitcoin approached the aggregate speculator breakeven level (~$65,800). This mark will act as support, and in case of a breakdown, it will provoke a correction up to $60,000, according to CryptoQuant analysts, writes The Block.

According to experts, traders closing arbitrage transactions increased downward pressure on the rate of the first cryptocurrency.

Now “the market lacks bullish momentum,” which has led to quotes moving below the key level of $65,800. However, the pressure on the price may be limited, experts noted.

Traders are in no rush to restock coins, demand growth from whales remains weak, and stablecoin volume is growing at its slowest pace since November 2023.

The head of the derivatives department at Bitfinex, Jag Kooner, confirmed CryptoQuant’s data regarding the situation in the derivatives market.

The specialist reported a drop in the volume of open positions in Bitcoin futures on CME by $1.2 billion over the past ten days.

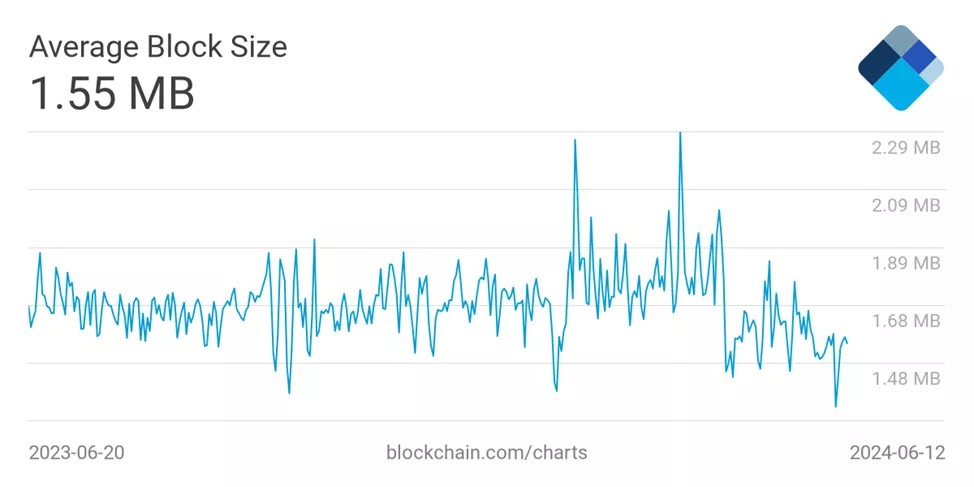

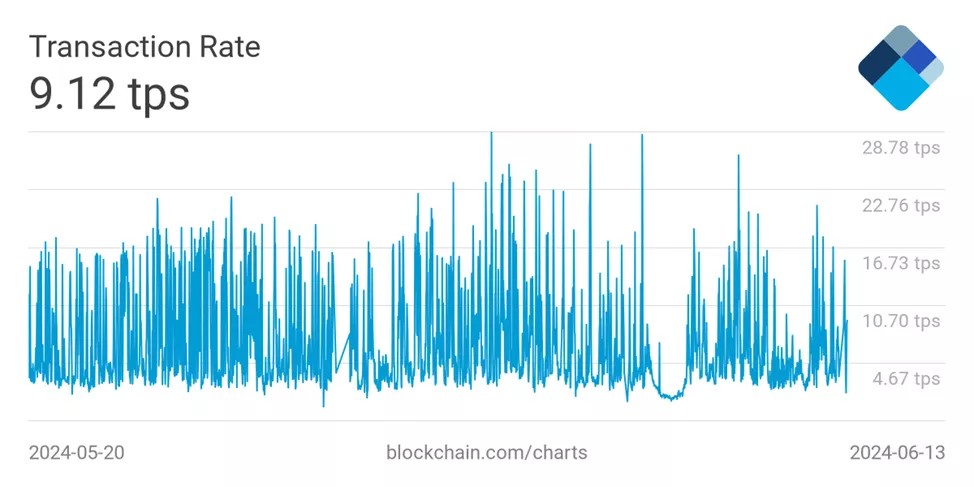

Against the backdrop of weakening market activity, there is also a decrease in the average block size and TPS.

The first indicator reached a yearly minimum on June 7. The second after peaking above 28 TPS dropped to the current 9.12 TPS.

Previously, Glassnode indicated that to exit range trading, a decisive price movement in any direction is necessary.

Prior to this, analysts came to the conclusion that transactions on the difference in quotations between the spot and derivative markets were restraining buying pressure in BTC-ETFs.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.