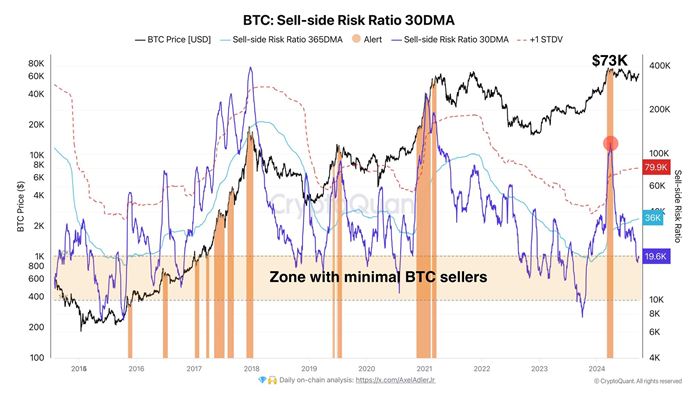

CryptoQuant emphasized that the risk of large-scale Bitcoin sales is at a minimum level since the beginning of 2024.

“The number of people willing to sell Bitcoin has fallen to a minimum over the past six months, since the peak at $73,000. The risk ratio of selling, which sums up all realized gains and losses on the network in a day and divides it by the realized market cap of Bitcoin, is now below 20,000. For comparison, during the peak in March, this figure reached almost 80,000,” the analysts noted.

In their opinion, even short-term holders of cryptocurrency are now “in the black” after a long period of losses, and the market has entered a phase of equilibrium.

Experts note that the macroeconomic environment is becoming increasingly favorable for risky assets, including cryptocurrencies, and in the medium term, the Bitcoin rate may exceed the $67,000 mark.

Earlier, experts from the analytical company 10x Research reported that in October, the first cryptocurrency could demonstrate a new historical maximum due to the presence of two catalysts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.

![News and prognosis of the price of the pound sterling: GBP/USD shoots above 1,3400 [Video] News and prognosis of the price of the pound sterling: GBP/USD shoots above 1,3400 [Video]](https://editorial.fxsstatic.com/images/i/GBPUSD_Large.png)