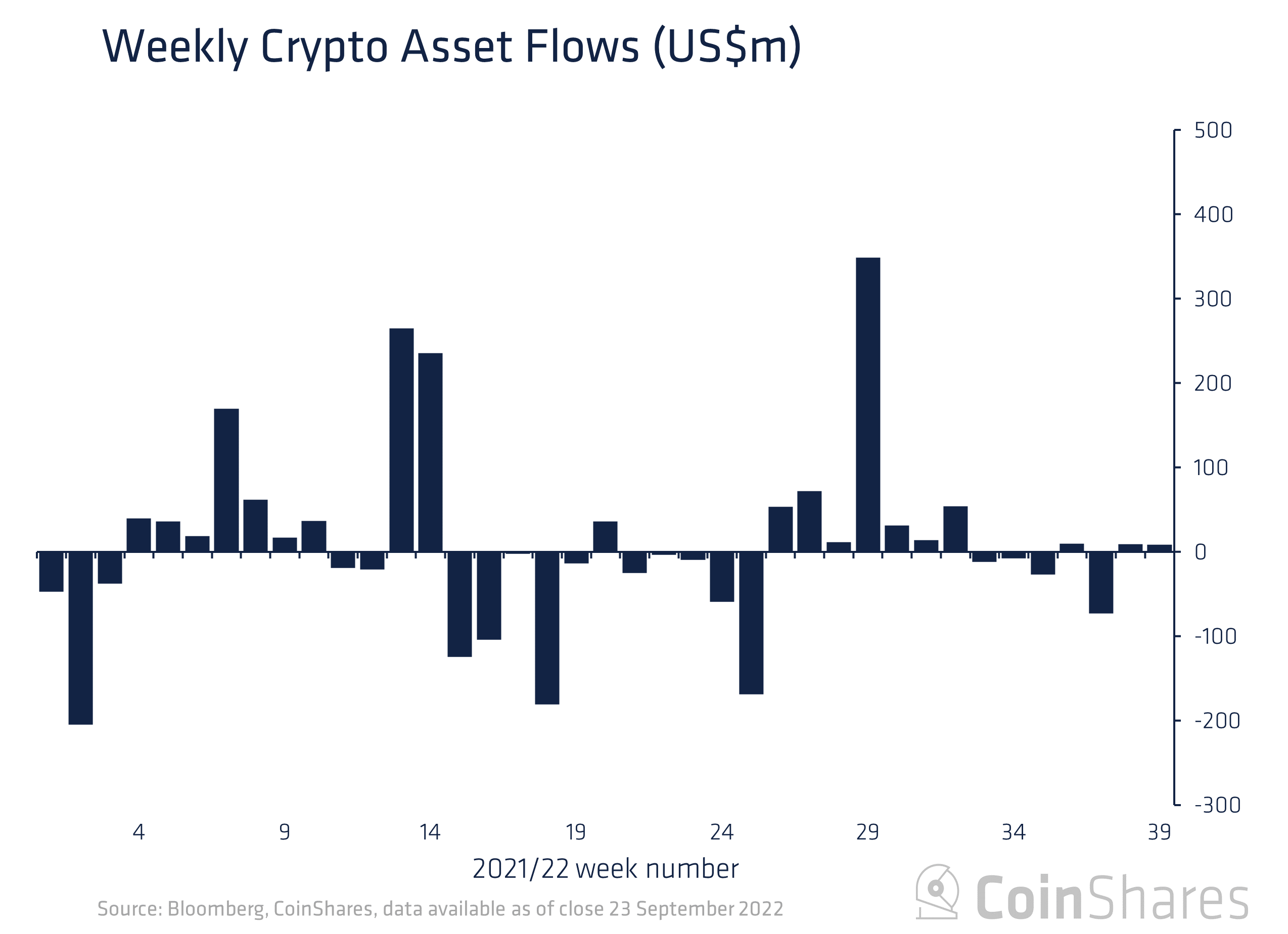

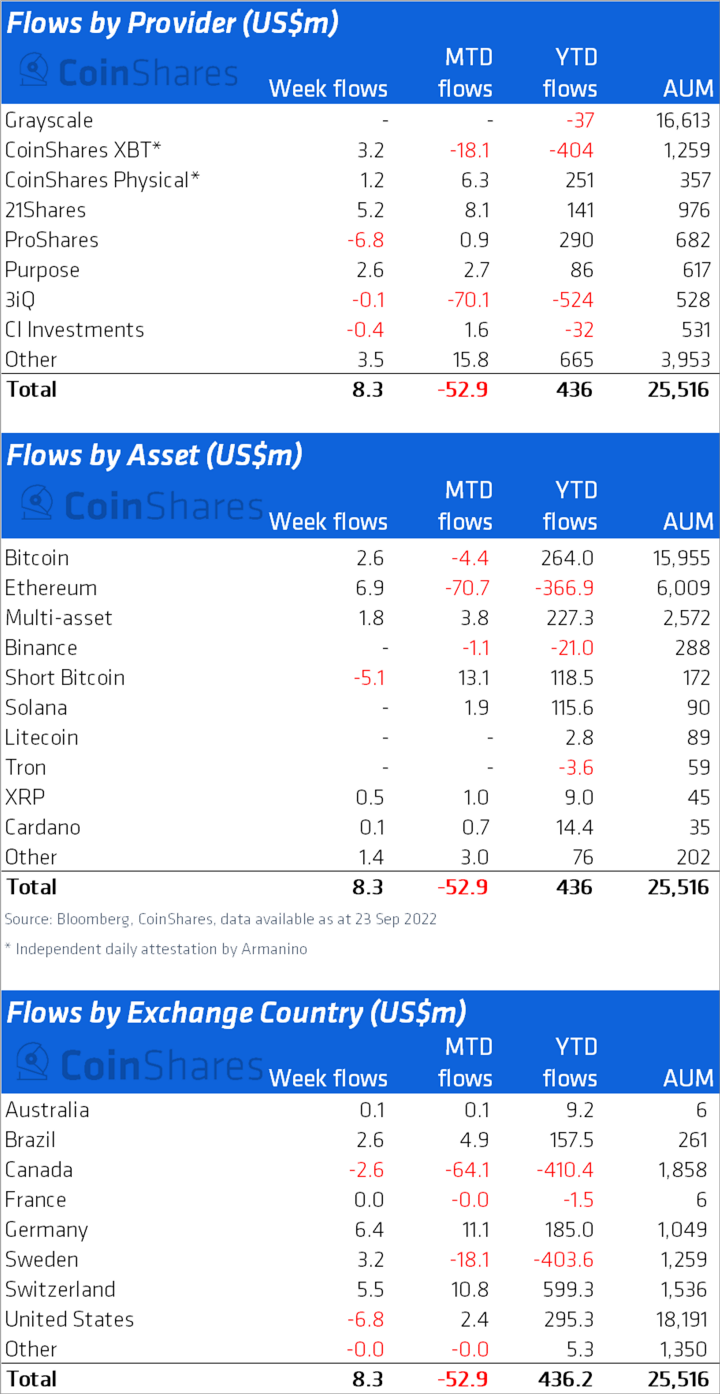

Analyst firm CoinShares reported that last week the influx of investments in digital assets amounted to only $8.3 million, which indicates a moderate investor interest in cryptocurrencies.

According to analysts at CoinShares, Bitcoin posted a modest influx totaling $0.1 million last week, with recent price action pushing total assets under management (AuM) to $15.9 billion, the lowest level since late June. The volume of short positions on bitcoin rose to $172 million, which was the highest figure on record. This caused some profit taking with the first outflow in seven weeks totaling $5.1 million.

Ethereum recorded a $7 million investment inflow last week, the first positive after a successful merger and four-week outflow. The recent launch of a short investment product on Ethereum resulted in a modest $1.1M inflow of funds. Investors continue to favor multi-currency products, which saw inflows of $1.8M last week. Cosmos and XRP recorded inflows of $0.4M and $0.5M , respectively.

Experts from the analytical company Glassnode believe that bitcoin is trading below $20,000 due to strong pressure from the US Federal Reserve and an unfavorable macroeconomic climate. According to them, BTC will continue to trade in the $17,000-$25,000 range.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.

![News and prognosis of the price of the pound sterling: the rebound of the GBP/USD could lose strength after the inflation of the United Kingdom [Video] News and prognosis of the price of the pound sterling: the rebound of the GBP/USD could lose strength after the inflation of the United Kingdom [Video]](https://editorial.fxsstatic.com/images/i/GBPUSD-bearish-object_Large.png)