- The Canadian dollar advances, extending its weekly gains.

- Canada’s unemployment rate missed expectations, making it difficult for the CAD to rise.

- The CAD gains 17,500 jobs, all of them part-time; wage growth also declines.

The Canadian Dollar (CAD) continues to rise against the US Dollar (USD) following the US Non-Farm Payrolls (NFP) report, which came in below expectations and recorded its lowest reading since February 2021.

The US data is good news for investors who were hoping for a cooling US economic data to convince the Federal Reserve (Fed) that there is no need for further rate hikes and to help push the US central bank towards eventual rate cuts.

Daily Market Movement Summary: Canadian Dollar Benefits from Poor US Data, Although CAD Data Worse

- The Canadian dollar advances after the US NFP returned a result of 150,000, its lowest figure in almost three years.

- Wages in the US did not give the signal either, with average hourly earnings only rising 0.2% (forecast 0.3%, previously revised from 0.2% to 0.3%).

- The net change in employment in Canada was below expectations, at 17,500 jobs, compared to 22,500 expected and 63,800 previously.

- The increase in employment in Canada reveals the low quality of the data, as the increase in employment occurs entirely in the part-time category, while full-time employment evaporates.

- Most of the new jobs are in the services sector, the goods sector only added 7.5 thousand jobs.

- Canada’s October unemployment rate stood at 5.7%, its highest level since February 2022, accelerating above the forecast of 5.6%, up from 5.5% in September.

- The US unemployment rate also rises to 3.9% after markets expected it to remain stable at 3.8%.

- The US ISM services Purchasing Managers’ Index (PMI) also failed, falling to 51.8 in October.

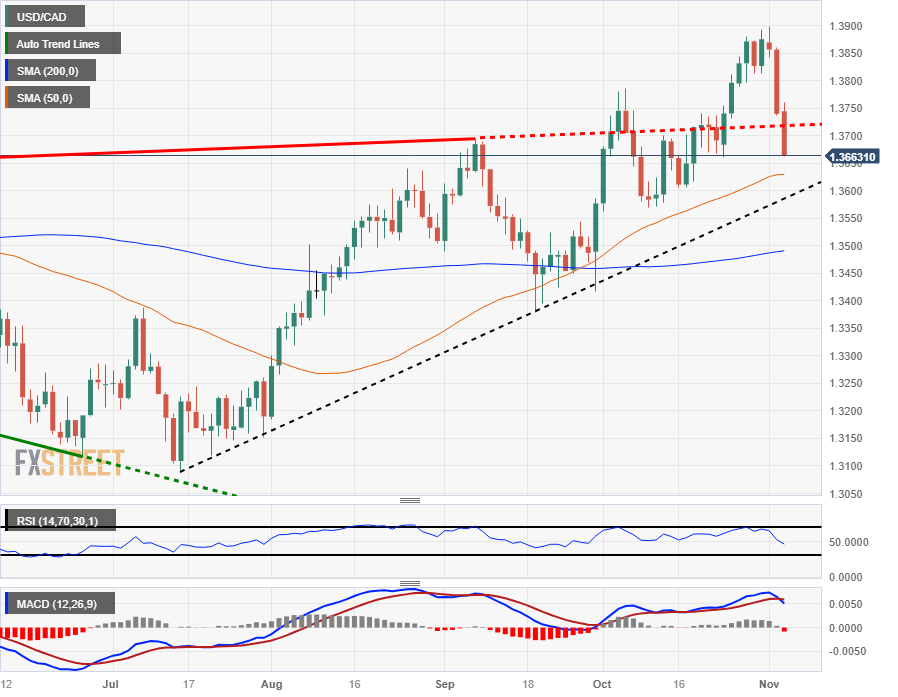

Technical Analysis: Canadian Dollar Seeks Highest Prices in Almost Two Weeks as US Dollar Recedes

The Canadian Dollar (CAD) is finding gains while the US Dollar (USD) retreats against the broader market.

The USD/CAD pair fell to an intraday low of 1.3665 after the NFP print, inches away from breaking a two-week low beyond 1.3661.

The USD/CAD pair is set for a pullback towards the 50-day SMA near 1.3625, with longer-term declines seeing a price bottom near 1.3500 at the 200-day SMA.

To the upside, a bullish breakout will have to find enough momentum to break the 1.3900 zone before USD/CAD can reach 12-month highs again beyond the late 2022 high of 1.3978.

USD/CAD Daily Chart

Frequently Asked Questions about the Canadian Dollar

What are the key factors driving the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of oil, Canada’s largest export, the health of its economy, inflation and trade balance, which is the difference between the value of Canada’s exports versus its imports. Other factors are market sentiment, that is, whether investors are betting on riskier assets (risk appetite) or looking for safe havens (risk aversion), with risk appetite being positive for the CAD. As a major trading partner, the health of the US economy is also a key factor influencing the Canadian dollar.

How do Bank of Canada decisions influence the Canadian dollar?

The Bank of Canada (BoC) significantly influences the Canadian dollar by setting the level of interest rates that banks can lend to each other. This influences the level of interest rates for everyone. The BOC’s main objective is to keep inflation between 1% and 3% by adjusting interest rates up or down. Relatively higher interest rates are usually positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the first being negative for the CAD and the second being positive for the CAD.

How does the price of oil influence the Canadian dollar?

The price of oil is a key factor influencing the value of the Canadian Dollar. Oil is Canada’s largest export, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD also rises, as aggregate demand for the currency increases. The opposite occurs if the price of oil falls. Higher oil prices also tend to result in a higher probability of a positive trade balance, which is also support for the CAD.

How does inflation data influence the value of the Canadian Dollar?

Although inflation has traditionally always been considered a negative factor for a currency, reducing the value of money, the opposite has actually happened in modern times, with the relaxation of cross-border capital controls. Inflation tends to lead central banks to raise interest rates, which attracts more capital from international investors looking for a lucrative place to store their money. This increases the demand for the local currency, which in the case of Canada is the Canadian Dollar.

How does economic data influence the value of the Canadian dollar?

Macroeconomic data releases measure the health of the economy and can influence the Canadian dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer sentiment surveys can influence the direction of the CAD. A strong economy is good for the Canadian dollar. Not only does it attract more foreign investment, but it may encourage the Bank of Canada to raise interest rates, resulting in a stronger currency. However, if economic data is weak, the CAD is likely to fall.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.