Today, the rate of the world’s main cryptocurrency fell to the level of $38,223, the level of March 15. This is 20% lower than the peak values of the end of March, when almost 48,000 dollars were given for 1 BTC. In the course of the day, the Bitcoin rate rose slightly and is now at the level of $38,800, however, analysts believe that the world’s main cryptocurrency will fall in the short term.

“Bitcoin breaks key 2-month trend line, which could mean further pullback to January lows”, says Fundstrat analyst Mark Newton, quoted by Market Watch. He expects bitcoin to drop to $36,300 and if it goes lower, he could test the $32,950 level.

Investors are waiting for a significant increase in the Fed’s base interest rate in the coming months, so some of the factors that support the demand for cryptocurrencies are coming to naught.

“As it becomes more profitable to hold dollars, investors can shift funds from bitcoin or gold”– say Nydig experts. “We see a negative correlation of bitcoin performance with both the dollar and interest rates.”.

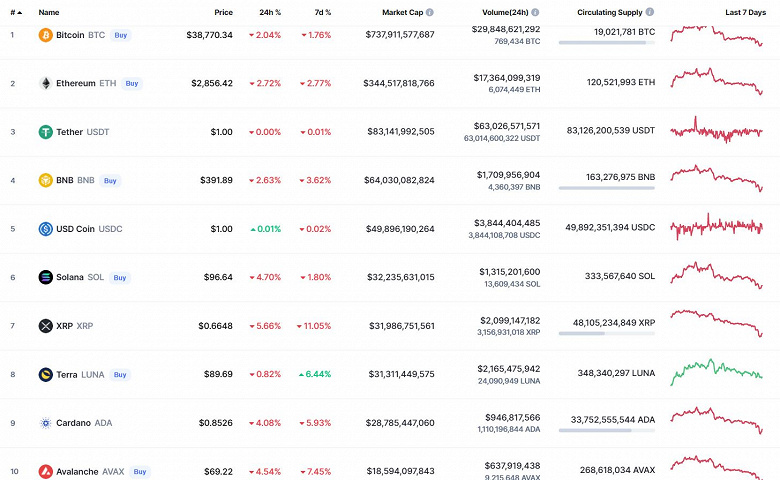

Along with Bitcoin, other cryptocurrencies are also falling. Thus, the Ethereum rate over the past 24 hours has decreased by 2.8%, Solana has fallen by 4.7%, Cardano – by 4.2%. But Elon Musk’s favorite cryptocurrency is growing – by 4%. Perhaps on the news that Twitter will still be sold to a billionaire.

Source: ixbt

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.