- AUD/USD bulls are looking to test key trend line resistance.

- The bulls need to break above the lows of last month.

The alcists progress well at the beginning of the weekthe price has headed towards the target and has even tested the 0.63 area as indicated by the chart.

AUD/USD Preview Analysis H1 Chart

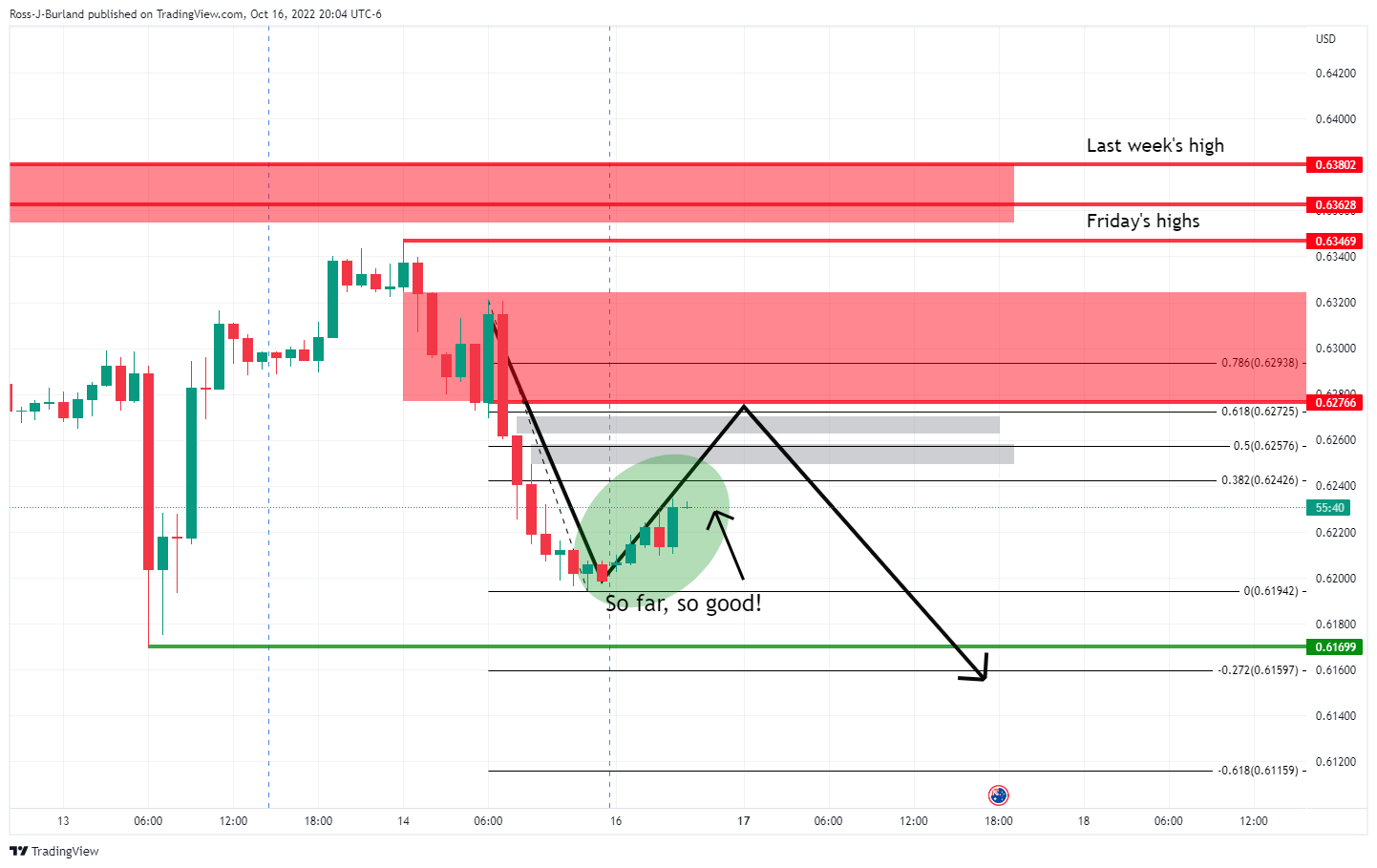

According to the hourly chart, it is explained that AUD/USD is “well below last month’s lows and will remain in the hands of bears as long as Friday’s highs near 0.6250 are not violated.”

For the opening of the sessions on Monday, a correction was expected in the gray areas that are the imbalances of the prices on the hourly chart, which put the lows of the previous bullish candle in the spotlight near a retracement of 61.8% of the Fibonacci level near 0.6275. It was said that “as long as it is below this resistance zone, the focus will be on a break of the new bearish cycle lows near 0.6170 and for a bearish continuation.”

Later in the session…

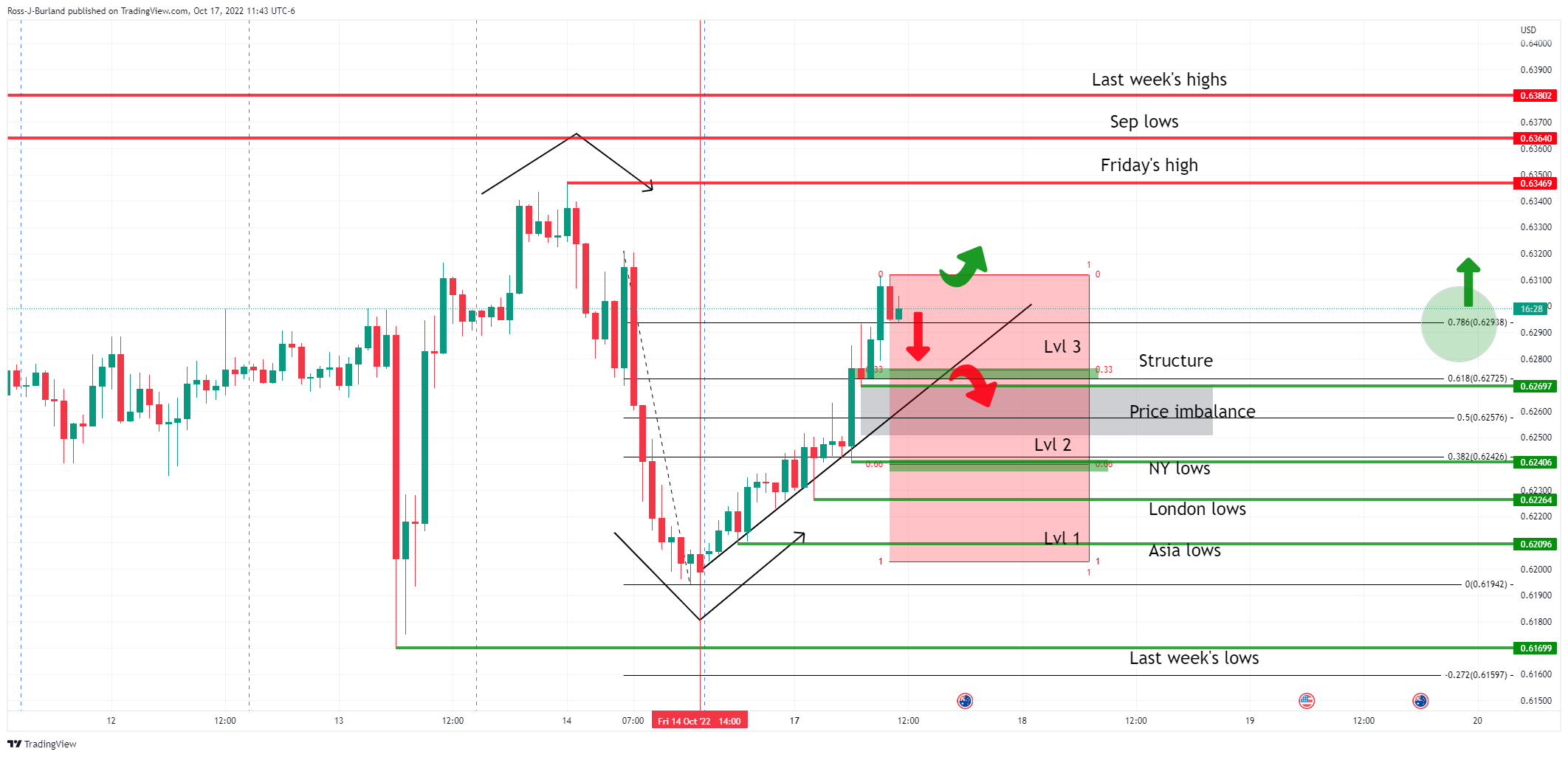

AUD/USD Update

The price has risen in three sessions, Asia, London and New York, in three levels of rise, respecting the front of the trend line and breaking a 78.6% fibonacci retracement level. Following this move, a correction back to profitable trades at level 2 would be expected, or even to Asian longs at level 1 if the bulls capitulate at level 2. There is also a price imbalance below level 3 which could be mitigated. If the bears commit, the longs at level 1 will be vulnerable considering the breakout of the bullish structure around 0.6270 on the backside of the trend line. On the other hand, if the bulls stay the course to the front of the trendline, Friday’s highs near 0.6347 are expected to hold September’s lows and last week’s highs thereafter.

AUD/USD H4 Chart

Meanwhile, the price is at the front of the 4-hour trend line resistance, which opens up the risk of a break below 0.6170 in the foreseeable future. However, if the bulls manage to get to the tailside of the trend, then there will be a bullish case developing above the lows of last month.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.