Spread between reverse repo operations o/n and the yield on four-week US Treasury bills of ~0.9% limits the amount of liquidity for buying risky assets like bitcoin, said former BitMEX CEO Arthur Hayes.

My theory on why Fed rate cuts aren’t going to plan.

Since JAYPOW annc Sept rate cut at J-Hole, $BTC down 10%, y? I that rate cuts were good for risk assets.

RRP pays 5.3% no T-bill under 1-yr maturity pays more. MMF will move money from T-bill -> RRP which is $ liq -ve.

Since…

— Arthur Hayes (@CryptoHayes) September 2, 2024

The expert noted that since the moment when Federal Reserve Chairman Jerome Powell announced the easing of monetary policy in September, Bitcoin has lost 10% in price.

Hayes explained the negative dynamics by the fact that money market funds can move capital from short-term US Treasury bills (4.38%) to reverse repo transactions with the Federal Reserve (5.3%), which provides a risk-free return of 0.92%.

After Powell’s speech, the volume of the latter increased by $120 billion. According to the former CEO of BitMEX, this situation will continue as long as the rates T-Bill will be lower than RRP.

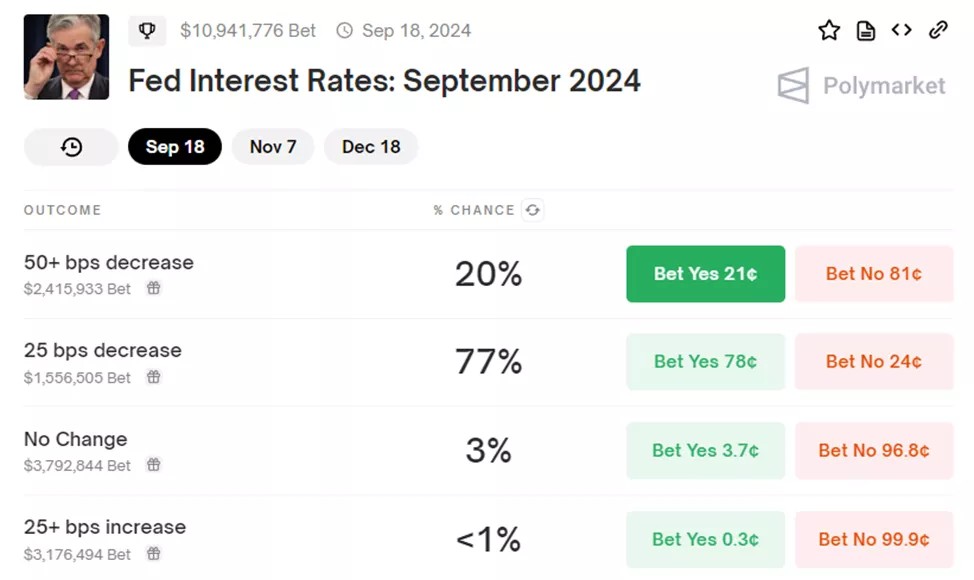

Futures show rate cut probability Fed by 25 bp at the meeting on September 18 is 69%, by 50 bp – 31%.

On the Polymarket prediction platform, these odds are are being evaluated 77% and 20%, respectively. The volume of bets reached $10.9 million.

From August 25 to August 31, clients withdrew $305 million from crypto funds. CoinShares analysts attributed the negative dynamics to macroeconomic data in the US, which reduced the likelihood of a 50 bps Fed interest rate cut.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.