Two main reasons led to Bitcoin breaking through the key resistance level at $48,000 in February and reaching levels above $52,000. consider QCP Capital analysts.

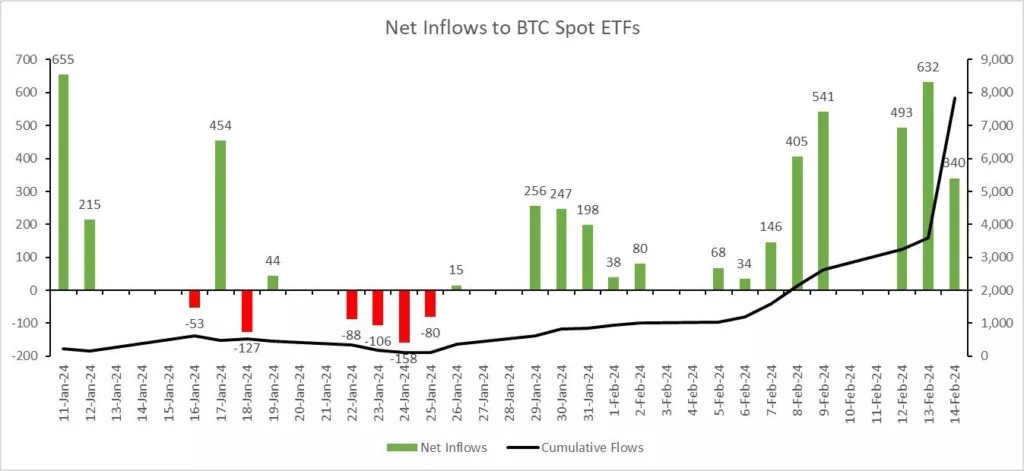

One of the factors was the flow of funds into spot ETFs based on the first cryptocurrency. At the end of January, the market returned to “net inflow territory.” On February 13, the daily figure reached $631 million, which is comparable to a record first trading day for products.

They consider the second driver to be an increase CME margin requirement. Leveraged short BTC traders were forced to provide greater coverage in a relatively low liquidity environment due to the Chinese New Year celebrations.

QCP Capital predicted a return of Bitcoin to historical highs in March.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.