Experts associated Bitcoin’s achievement of a historical high of $74,000 in March with speculative play against the backdrop of the launch of spot Bitcoin ETFs and the growth of stablecoin capitalization.

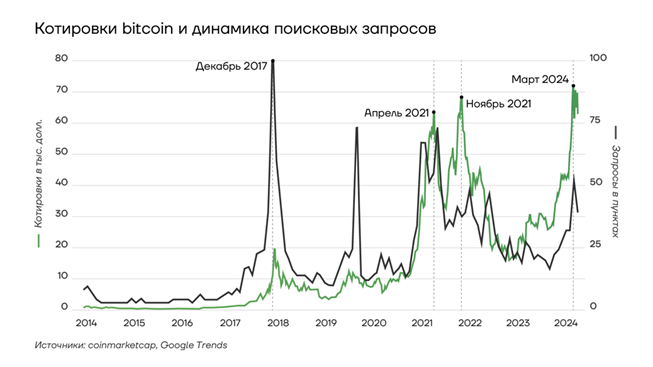

The rise in the price of Bitcoin in March did not cause a stir similar to the situation at the end of 2017. This is indicated by the number of search queries related to cryptocurrencies, which remained below peak values.

The maximum number of requests on the topic of cryptocurrency occurred at the end of 2017. Each subsequent period of growth in quotations was accompanied by less and less excitement. In March, interest, judging by the number of requests, was half as much as seven years ago.

According to experts, the mining-based transaction scheme of the Bitcoin network is an obstacle to the full inclusion of digital assets in the classical financial system.

Bitcoin's performance in the markets is more in line with the performance of high-risk assets such as technology stocks. According to experts, the first cryptocurrency is much more strongly correlated with the movement of the stock market than with gold, and is a high-risk speculative asset.

The report states that Bitcoin's weak reaction to the halving suggests that the impact of technical factors is decreasing, and the behavior of BTC is determined by the level of willingness of market participants to take on risks.

Analysts believe the range of Bitcoin price forecasts through the end of 2024 is extremely wide, with average highs and lows of $121,764 and $50,138, respectively.

Earlier, analysts at The Block Researches reported that the seven-day average number of new addresses on the Bitcoin network fell to the lowest level in 2018.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.