The upcoming reduction in the Bitcoin block reward will help create a greener mining network with sustainable energy sources. At the same time, limited supply will affect the price of the asset.

Pure mining

Fineqia International analyst Matteo Greco said Cointelegraphthat halving will encourage companies mining the first cryptocurrency to optimize their capital efficiency through cheaper electricity. This will lead to increased use of renewable sources.

Reducing the reward also encourages improvements in equipment efficiency, making the network more resilient, the expert said.

According to the January report Bitcoin ESG Forecast by Daniel Batten, about 54.5% of Bitcoin's energy consumption comes from renewable sources.

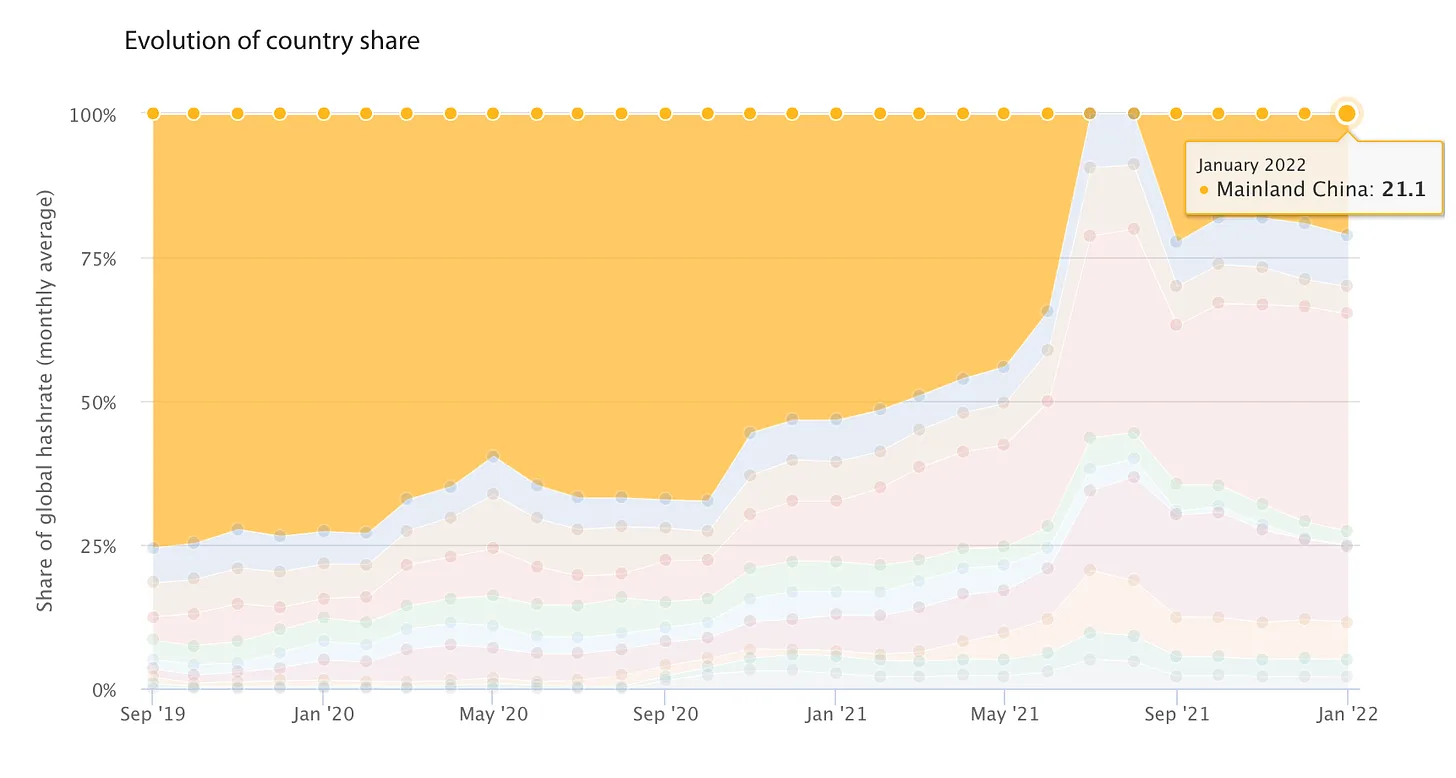

IN note on April 5, Batten writes that China accounts for about 15% of the global hashrate of the first cryptocurrency, despite the ban on mining in the country.

Instead of traditional methods, Chinese miners rely heavily on hydroelectric power, which is relatively cheap, especially during rainy months, Batten writes.

He noted that a significant number of retail autonomous market participants are mining Bitcoin at a loss due to high electricity tariffs. However, their main goal is to “exit the Chinese financial system”:

Need for an upgrade

The main advantage of the Bitcoin blockchain is that miners know when the block reward reduction will occur and can prepare for it. In addition, the event carries a serious shock to the demand for the asset.

Founder and CEO of the Demand mining pool Alejandro De La Torre expressed excitement for the upcoming halving:

However, such a “shake-up” could also mark the end for some market participants.

According to Bitfarms CEO Ben Gagnon, if the increase in the price of Bitcoin does not compensate for the reduction in the block reward, then “old miner models released three to five years ago” will lose their economic efficiency.

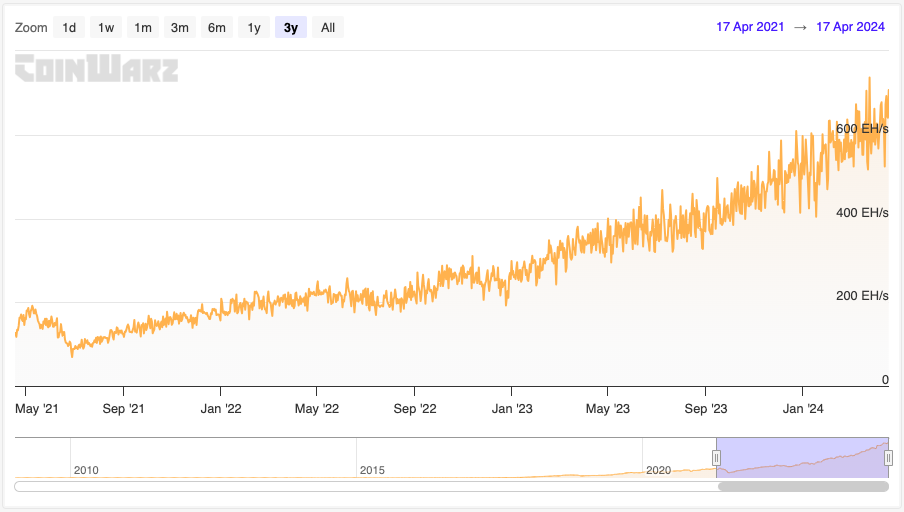

He also noted that the continuous growth of the global hashrate “signals an equipment upgrade” by the miners of the first cryptocurrency.

Global Bitcoin hashrate. Data: CoinWarz.

Global Bitcoin hashrate. Data: CoinWarz.

Migration

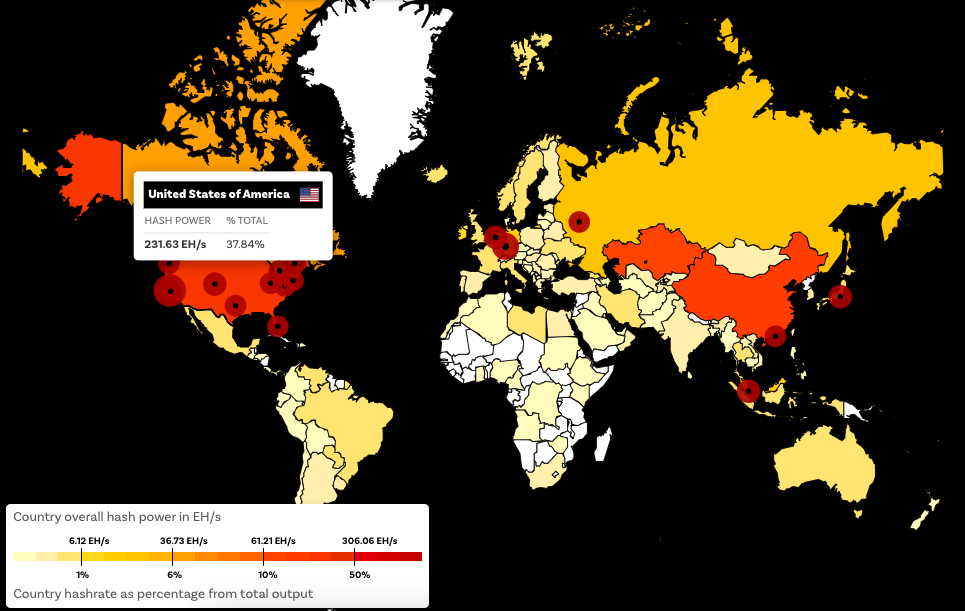

According to Chain Bulletinthe global share of miners is still concentrated in the United States – almost 38%.

De La Torre believes that the halving will have the greatest impact on the United States due to the high hashrate in the country. The impact will force inefficient miners to shut down their rigs “either completely or temporarily” to upgrade their infrastructure.

According to the expert, the reduction in the award could be an excellent opportunity for countries with low purchasing power, as older generation equipment enters the market en masse.

Garrido said energy costs are the most significant metric for miners, although a safe regulatory environment is also important.

Thanks to a favorable regulatory environment, the US is one of the most popular places for Bitcoin mining, despite the high cost of energy.

The CEO of Bitfarms noted the opportunity for Bitcoin miners to move on to mining other assets with the SHA-256 hashing algorithm. However, Bitcoin Cash (BCH) and Bitcoin SV (BSV) are the only coins with such a model, and their capitalization and quotes are significantly inferior to the first cryptocurrency.

Earlier it became known that mining companies began a race for the first block that will appear after halving in order to get an “epic” Satoshi with an estimated value of several million dollars.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.