Glassnode analyst James Check, known under the nickname Checkmatey, doubted the capitulation of Bitcoin miners after the halving, although he admitted that they were “treading water.”

However, he estimates that no more than 5% of Bitcoin’s computing power is experiencing difficulties. The check believes that this is “not that much,” and the market situation does not look like a “total sell-off.”

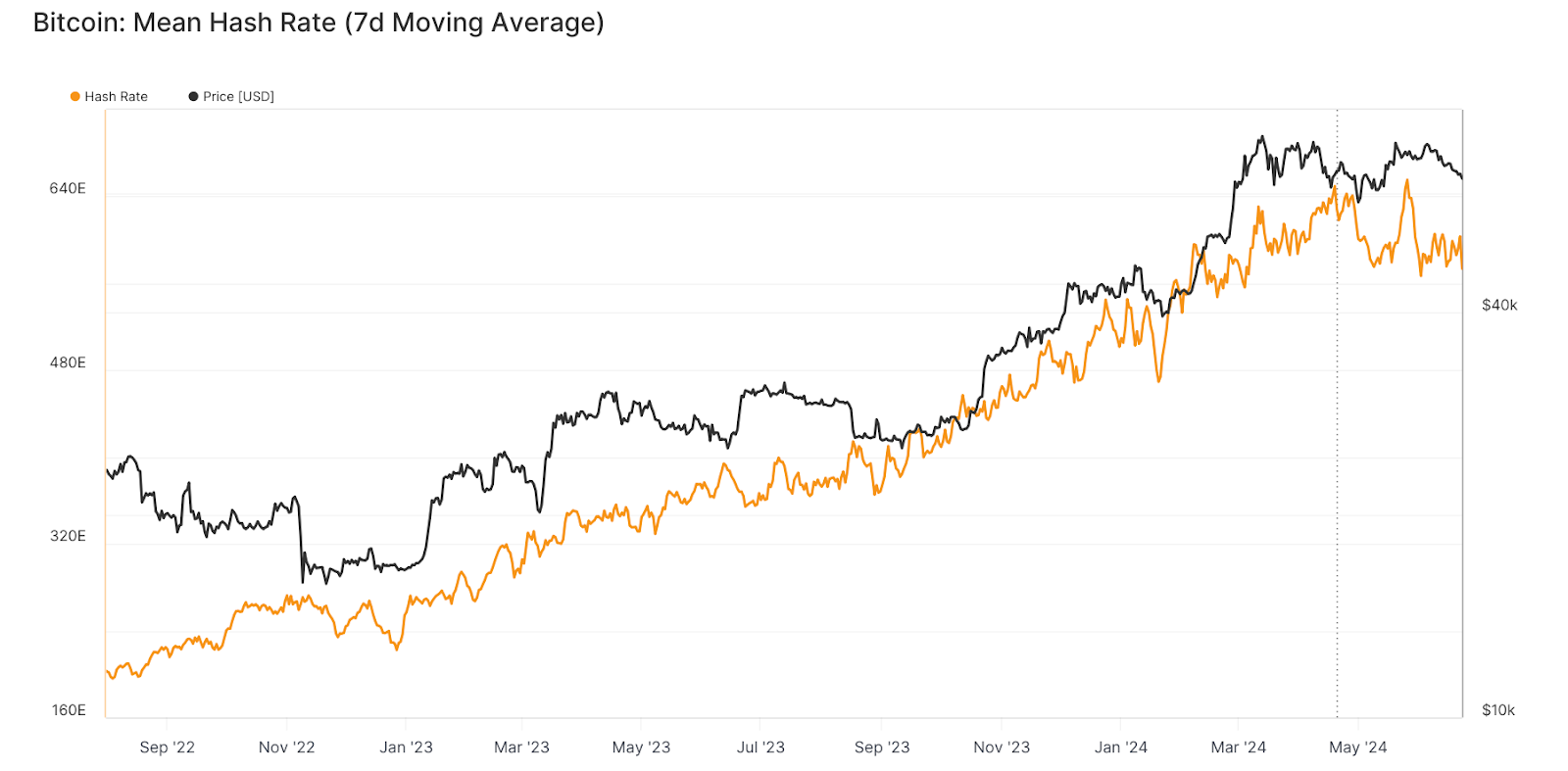

According to Glassnode, smoothed by the seven-day moving average (7 DMA), the hashrate is at 592.2 EH/s. The value is approximately 9% lower than the 649.7 EH/s recorded on the eve of the halving of the reward for the mined block in April.

The analyst also noted that the share of commissions in the total income of cryptocurrency miners reached 10%. According to him, miners need to adapt to a situation where network fees will become the main source of revenue after the block reward is reduced from 6.25 BTC to 3.125 BTC.

One very positive trend for #Bitcoin is that transaction fees represent an increasingly large proportion of miner revenues

Miners must adapt and adjust to fees becoming their primary revenue stream, forcing the industry to further innovate, and apply efficient capital management pic.twitter.com/hHTnW1qqhb

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) June 21, 2024

Earlier, the creator of the metric, founder of Capriole Investments Charles Edwards, drew attention to the inversion of Hash Ribbons – the excess of 30 DMA over 60 DMA.

In his opinion, the phase marks the capitulation of miners and gives an “optimal signal” about the profitable purchase of digital gold.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.