- Raymond James cuts the Amzn price objective from $ 275 to $ 195.

- Analyst Beck suggests that exposure to tariffs will harm perspectives and profits.

- Amazon will publish your first quarter on May 1, next week.

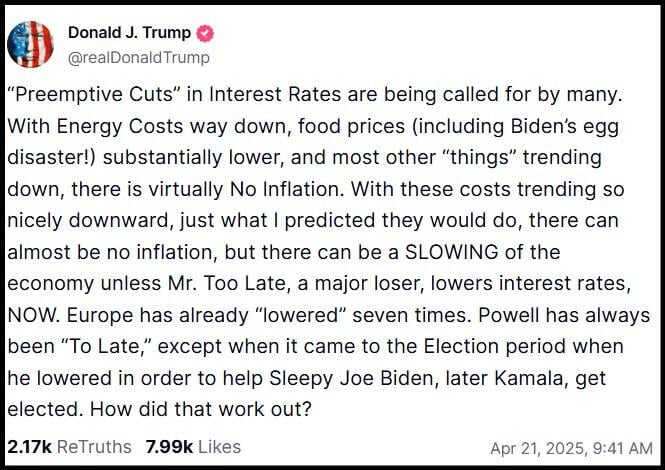

- Trump criticizes the president of the Fed again, Jerome Powell, pressing him to lower interest rates.

Amazon (AMZN) He suffered a drop in his action at the beginning of the week on Monday, after a prominent Wall Street investment bank reduced its price objective for the largest US electronic commerce supplier. AMZN’s shares negotiated a 3.5% lower 3.5%, below $ 167.

The main stock market indices of the US collapsed while the market evaluated how President Donald Trump undermined the independence of the Federal Reserve (Fed). The three US indices quoted below 2% at some times during Monday morning, and Nasdaq was in the worst situation with a 2.5% drop. The industrial average Dow Jones (DJIA) was somewhat better, lowering 2%.

On Friday, while the markets were closed, the Trump advisor, Kevin Hassett, suggested that the president was considering saying goodbye to the president of the Federal Reserve (Fed) Jerome Powell since he is disappointed that Powell has not been faster to lower interest rates.

This followed Powell’s speech in Chicago last week, where he said that Trump’s tariffs could revive inflation and make the central bank cut the rates.

Then, Monday morning, Trump published more negative statements about Powell on his social truth platform.

[T] There may be a deceleration of the economy unless Mr. Too late, a large loser, lowers interest rates, now. Europe has already “lowered” seven times. Powell has always been “too late,”

Donald Trump’s social truth publication on April 21, 2025

Wall Street is generally not happy when the independence of the Fed is challenged. Powell’s four -year mandate ends in May 2026, regardless of in approximately one year. Investors fear that drastic cuts in interest rates can exacerbate inflation and bring to a future rate increase cycle. The yields of the American treasure bonds in the short term saw descents on Monday, while the yields increased for bonds to 10 and 30 years. The y 30 -year bond yields rose 1.6%, while 1.45% fell in the 2 -year bonus.

News about Amazon’s actions

The Raymond James investment bank cut its price objective to 12 months for Amazon shares from 275 $ to $ 195. This represents a 29% cut in the price target. The reason given were the winds against the profits derived from the Trump tariffs, particularly on China.

Analyst Josh Beck said that since 30% of the gross value of Amazon goods and 15% of his ads were exposed to China, there would be a transition period with supply chains that would probably harm the short -term profitability.

The Trump administration has raised its general tariff on Chinese goods to an incredible 145%, while China has responded with its own 125% tariff on US assets. Reports have emerged that Amazon has opted, in some cases, for refusing to accept requests from China not to pay the tariff. This could harm many of its commercial relations with long -term Chinese suppliers.

The difficulty is aggravated, according to Beck, for the “increasing investment intensity” of Amazon in its AWS unit during the current macroeconomic turbulence cycle. This factor should also weigh on short -term profitability, although Raymond James is still very optimistic in the long -term Amazon.

Beck changed the perspective on Amazon shares of strong purchase to overcoming.

Amazon actions prognosis

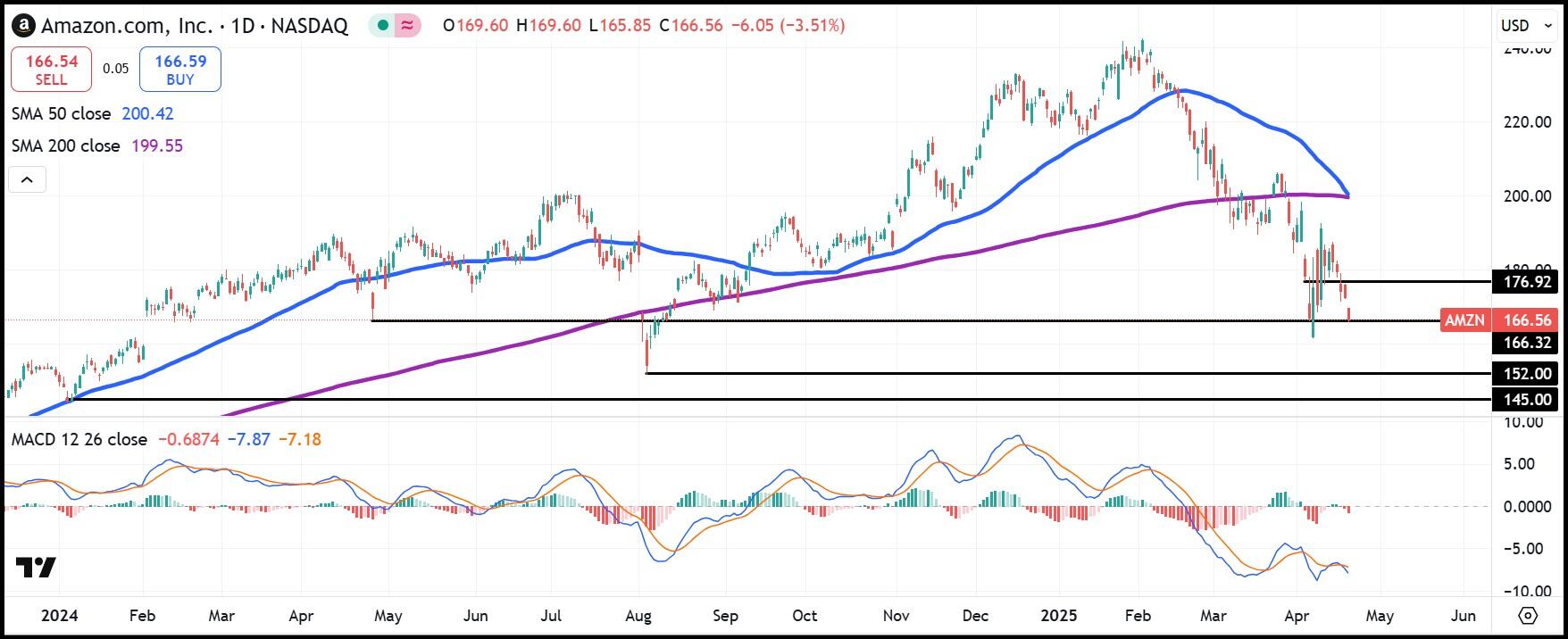

Amazon actions have more concern on Monday. The minimum intradic on Monday fell below the previous support at $ 166.32 since April 25, 2024. That leads us to wait for AMZN to fall even more than $ 152 or $ 145, both prominent support levels since January last year.

The indicator of convergence/divergence of mobile socks (MACD) looks terrible since it lies below the level -5 and does not show signs of reversion. In addition, the bassists will notice that the action is about to enter a cross pattern of death in which the single mobile (SMA) average of 50 days falls below its 200 -day counterpart. Typically, that event indicates a long -term bassist trend.

AMZN Shares Daily Chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.